Forex Market Learning Index

Complete guide to master forex market trading

Foundation Concepts

Advanced Trading

Smart Money Concept

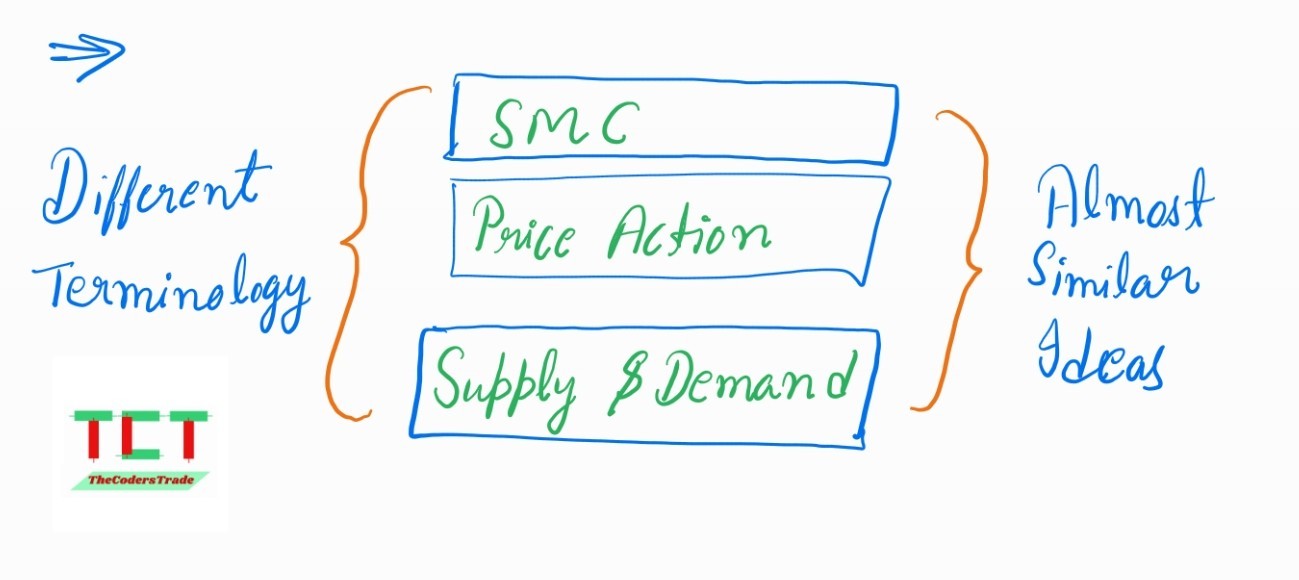

Before learning and deep diving in Smart Money Concept, let's understand it in brief.

The Smart Money Concept (SMC) is a trading and investing approach based on understanding and following the actions of large, institutional players in financial markets—like banks, hedge funds, and other big financial entities. These entities, often referred to as smart money, have the resources, expertise, and market influence to drive significant price movements.

SMC primarily applies to forex, stocks, and other liquid markets and revolves around reading price action to identify where smart money is positioning itself.

Here's a breakdown of the Smart Money Concept, explained step-by-step:

1. Core Principles of Smart Money Concept

Liquidity:

Markets need liquidity for large players to enter and exit trades. Smart money hunts liquidity zones, often where retail traders place stop-losses.

Market Structure:

Smart money focuses on market trends, breakouts, and reversals to identify potential trade setups.

Manipulation:

Institutional traders use tactics like stop hunts (grabbing liquidity above/below key levels) to execute trades at favorable prices.

Order Blocks:

These are zones where smart money leaves footprints. Price tends to return to these levels before continuing in the dominant trend.

Imbalance/Fair Value Gaps:

These are areas where price moves so quickly that not all orders are filled, creating gaps that price often retraces to fill.

Break of Structure (BOS):

This indicates a shift in market momentum and is key to identifying potential reversals or trend continuations.

2. Key Concepts in Smart Money Trading

a. Liquidity and Stop Hunts

What is liquidity?

Liquidity refers to areas in the market where there are many pending orders, such as stop-losses or buy/sell orders.

Smart money behavior:

Large players need liquidity to fill their massive orders, so they deliberately move the price to areas where liquidity is abundant.

Example:

Retail traders often place stop-losses above resistance or below support. Smart money pushes the price into these zones to trigger stop-losses, collect liquidity, and then reverse the price.

b. Order Blocks (OBs)

What are order blocks?

An order block is a price area where institutions have placed significant buy or sell orders. These are often visible as strong candlestick patterns before a major price move.

How to identify them:

Look for a sharp price move (bullish or bearish) preceded by a consolidation phase. Mark the last up candle before a down move (bearish order block) or the last down candle before an up move (bullish order block).

Why they matter:

Price often revisits these zones, offering a high-probability entry point.

Example:

If price consolidates and then drops sharply, the area where consolidation occurred is a bearish order block.

c. Market Structure and BOS

Market structure basics:

Uptrend: Higher highs (HH) and higher lows (HL). Downtrend: Lower highs (LH) and lower lows (LL).

Break of Structure (BOS):

When price violates the most recent high/low, it signals a potential trend change.

Example:

In an uptrend, if price breaks the most recent higher low (HL), it signals a potential downtrend.

d. Imbalances and Fair Value Gaps

What are imbalances?

These are gaps in price where buying or selling activity was so aggressive that not all orders were matched.

Why they matter:

Price often retraces to these zones before continuing the trend.

Example:

After a strong bullish move, a gap in price (on lower timeframes) signals an imbalance. Price may return to fill this gap before resuming upward.

3. How to Use Smart Money Concept in Trading

Step 1: Identify Market Structure

Determine the overall trend by analyzing higher highs/lows or lower highs/lows on your chart.

Step 2: Spot Liquidity Zones

Look for areas where stop-losses or pending orders might be located: above resistance or below support, around psychological levels (e.g., round numbers).

Step 3: Mark Order Blocks

Use historical price data to identify bullish or bearish order blocks.

Step 4: Look for Break of Structure

Wait for price to confirm a shift in momentum by breaking a significant high or low.

Step 5: Wait for Retracement

Use Fibonacci retracement levels, imbalances, or order blocks to identify entry zones.

Step 6: Enter Trades

Look for confluences like candlestick patterns or divergence to refine your entries. Place stop-losses just beyond the invalidation point (e.g., above/below order blocks).

Step 7: Manage Risk

Use proper risk management (e.g., risking 1-2% per trade). Aim for favorable risk-reward ratios (e.g., 1:3 or higher).

4. Example of Smart Money Concept in Action

Scenario:

The market is in an uptrend, forming higher highs (HH) and higher lows (HL).

A resistance level forms at 1.2000. Retail traders place sell orders or stop-losses above this level.

A bullish order block is identified below at 1.1950, where consolidation occurred before a previous rally.

Price breaks above 1.2000, triggering liquidity above resistance.

Price retraces to the bullish order block at 1.1950, filling the imbalance.

Enter a buy position at 1.1950 with a stop-loss below the order block and a target above the previous high.

Price resumes its uptrend, hitting the target and providing a high-risk-reward trade.

5. How to Master the Smart Money Concept

Practice identifying liquidity zones, order blocks, and imbalances on different timeframes.

Use historical data to test your understanding of SMC principles.

Review your trades to understand what went wrong or right.

Use SMC alongside tools like Fibonacci, RSI, and moving averages for better confluence.

Stick to your trading plan and manage risk consistently.

6. Common Mistakes in Smart Money Trading

- •Ignoring higher timeframes

- •Overanalyzing or marking too many zones

- •Trading without a clear plan or confluence

- •Entering trades without waiting for confirmation

Summary

The Smart Money Concept is a powerful trading methodology that focuses on understanding institutional behavior. By mastering liquidity zones, order blocks, market structure, and imbalances, you can improve your trading accuracy and profitability. However, patience, discipline, and consistent practice are key to mastering SMC.

One important line to always remember in SMC trading: "If you don't know where the liquidity is then you are the liquidity"

SMC TECHNIQUES HELP TO:

- Track the retailer liquidity & How to capitalize on it

- Broader perspective when viewing charts

- High reward to risk trade opportunities

All The Topics Of Smart Money Concept Are Covered Below In A Structured Manner And In-Depth Topic by Topic

#Happy Learning

1.Introduction to Smart Money Concepts (SMC)

What is SMC? Smart Money Concepts focus on analyzing how institutional traders (banks, hedge funds, etc.) move the market. Unlike retail traders who make decisions based on emotions or small-scale strategies, smart money operates with large capital and uses specific strategies to control liquidity and manipulate prices.

Why SMC Matters: Retail traders often get caught in traps set by institutional traders. By understanding SMC, you can avoid these traps and trade in alignment with the smart money.

Example: Imagine you're trading Nifty stocks. The price of Reliance stock is ₹2,500. Retail traders might notice the price struggling to break ₹2,600 and assume it's a strong resistance. They short the stock, expecting it to fall. However, institutional traders push the price above ₹2,600 briefly to trigger stop-loss orders before reversing the trend and taking the stock down to ₹2,400. SMC helps you recognize such traps and plan accordingly.

2.Liquidity is Crucial for Smooth Asset Transactions

What is Liquidity? Liquidity is the ability to buy or sell an asset quickly without causing significant price changes. High liquidity ensures smoother transactions and smaller bid-ask spreads.

Why Liquidity Matters: Markets with high liquidity allow large volumes of trades without causing wild price swings. In contrast, low liquidity makes it harder to enter or exit trades without significant price changes.

Example in Rupees: In the forex market, trading EUR/INR is smooth because of high liquidity. If you want to buy €1,000 worth ₹88,000, you'll get this price instantly. However, trading an illiquid stock with fewer buyers and sellers, like a small-cap stock priced at ₹88, could cause the price to rise sharply if you buy in bulk.

3.Trading Smart Money Concepts Across Markets

Which Markets Work Best for SMC? SMC strategies can be applied to multiple markets, each with unique characteristics:

Forex: High liquidity pairs like USD/INR make price manipulation by smart money evident.

Crypto: High volatility creates opportunities but also risks due to limited regulation.

Indices: Nifty 50 or Sensex are ideal for SMC because they have institutional-level participation.

Stocks: Blue-chip stocks like TCS or Infosys exhibit smart money patterns due to heavy institutional interest.

Example: In crypto, Bitcoin may consolidate at ₹25,00,000, trapping retail traders into placing stop-loss orders below ₹24,50,000. Smart money may push the price below ₹24,50,000 briefly, capturing liquidity before rallying back above ₹25,00,000.

4.Small Cases for Informed Investment Decisions

What are Small Cases? Small cases are pre-designed portfolios based on themes, like renewable energy, high dividend-paying stocks, or blue-chip growth stocks. They provide diversified exposure to specific sectors or strategies.

Why They Matter? They reduce the complexity of selecting individual stocks, making it easier for retail investors to invest.

Example in Rupees: A small case focused on Electric Vehicle Growth might include stocks like Tata Motors, M&M, and battery manufacturers. If the small case is worth ₹10,000, buying it provides exposure to all these stocks proportionally.

5.Understanding Market Structure

What is Market Structure? Market structure refers to how price moves over time, forming patterns that reflect supply and demand. It consists of:

Major Structure: Long-term trends (e.g., bull or bear market).

Minor Structure: Short-term price movements within the major trend.

Example in Rupees:

▫ A bullish market structure occurs when price moves like this: ₹1,000 → ₹1,200 → ₹1,100 → ₹1,400 → ₹1,200 → ₹1,600 (higher highs and higher lows).

▫ A bearish market structure occurs when price moves like this: ₹1,000 → ₹800 → ₹900 → ₹700 → ₹800 → ₹600 (lower highs and lower lows).

6.Bullish Break of Structure

What is a Bullish Break of Structure (BOS)? A bullish BOS occurs when the price breaks and closes above a previous high, signaling continued upward momentum.

Example in Rupees:

▫ Price starts at ₹900 → ₹1,000 → ₹950 → ₹1,100.

▫ If the price closes above ₹1,100, it's a bullish BOS, suggesting that buyers are in control and the trend may continue upward.

7.Change in Market Structure

What is a Change in Market Structure? This happens when the market shifts from a bullish structure to a bearish one or vice versa. It's confirmed when price breaks a key high or low.

Example in Rupees:

▫ In a bullish market, price forms higher highs: ₹1,000 → ₹1,200 → ₹1,300.

▫ If the price breaks and closes below ₹1,200, it signals a change to bearish structure, indicating potential downward movement.

8.Deeper Pullbacks and Retail Liquidity

What are Deeper Pullbacks? Smart money uses deeper pullbacks to trap retail traders by triggering their stop-loss orders, collecting liquidity for larger price moves.

Example in Rupees:

▫ Price of a stock is ₹500 → ₹550 → ₹530 → ₹600.

▫ Retail traders place stop-loss orders just below ₹530. Smart money drives the price down to ₹520, collects liquidity, and then pushes the price back up to ₹600 or higher.

9.Understanding the Concept of a Bullish Break of Structure

A bullish break of structure (BOS) occurs when the price breaks and closes above a previous significant high. This confirms that buyers are dominating and that the market is likely to continue moving upward.

Key Points:

▫ A BOS indicates a strong buying trend.

▫ Institutional traders often trigger BOS movements to encourage retail traders to join the trend, creating liquidity.

Example in Rupees:

▫ The stock price of Infosys moves like this: ₹1,200 → ₹1,300 → ₹1,250 → ₹1,350.

▫ A BOS occurs when the price breaks above ₹1,350 and closes at ₹1,370. This signals further bullish movement. Retail traders often enter after the BOS, but smart money might wait for a small pullback before pushing the price higher.

10.Price Breaking and Closing Below Previous Higher Low (Bearish Change in Market Structure)

When the price in a bullish trend breaks and closes below the last higher low, it signals a shift to a bearish structure. This suggests sellers are gaining control.

Key Points:

▫ A break below a higher low often traps retail buyers.

▫ Smart money uses these moves to collect liquidity before reversing.

Example in Rupees:

▫ The price moves like this: ₹1,500 → ₹1,600 → ₹1,550 → ₹1,700.

▫ If the price breaks and closes below ₹1,550 (last higher low) at ₹1,520, it signals a bearish change in market structure.

11.Deeper Pullbacks Search for Retailer Liquidity

Deeper pullbacks occur when smart money pushes the price beyond typical support or resistance levels to capture retail stop-loss orders. This provides liquidity for larger market moves.

Key Points:

▫ Retail traders often place stop-loss orders near visible support or resistance levels.

▫ Smart money intentionally breaks these levels to collect those orders.

Example in Rupees:

▫ The price of a stock moves from ₹200 → ₹250 → ₹230 → ₹300.

▫ Retail traders place stop-loss orders below ₹230, expecting the price to continue upward.

▫ Smart money pulls the price down to ₹220, collects the stop-loss liquidity, and then pushes it back up to ₹300.

12.Identifying Market Structure Changes

Market structure changes occur when the price breaks key levels, shifting from bullish to bearish or vice versa. Recognizing these shifts is crucial for aligning trades with market trends.

Key Points:

▫ Look for clear breaks of higher highs or lower lows.

▫ Wait for confirmation (e.g., a strong close above or below the key level).

Example in Rupees:

▫ In a bullish trend: ₹800 → ₹900 → ₹850 → ₹1,000.

▫ A market structure change happens if the price falls below ₹850 and closes at ₹830, signaling a bearish trend.

13.Weak Highs and Lows are Easily Taken Out by the Market

Weak highs and lows are price levels that lack strong institutional support. These levels are often targeted by smart money to create liquidity.

Key Points:

▫ Weak highs/lows are usually formed by retail traders.

▫ Smart money pushes the price through these levels to trigger stop-loss orders.

Example in Rupees:

▫ The price of a stock is ₹600 and forms a high at ₹650.

▫ Retail traders assume ₹650 is a strong resistance and place sell orders.

▫ Smart money pushes the price to ₹660, taking out the weak high before reversing back below ₹650.

14.Understanding Imbalances and Price Spikes in the Market

Imbalances occur when there is a large difference between buying and selling pressure, causing price to move rapidly in one direction, leaving gaps in the chart.

Key Points:

▫ Imbalances are often filled later as the market seeks equilibrium.

▫ Smart money uses these areas to enter or exit trades.

Example in Rupees:

▫ A stock price jumps from ₹1,000 to ₹1,050 within minutes, leaving a gap between ₹1,020 and ₹1,040 on the candlestick chart.

▫ This imbalance may be filled later as the price returns to the gap before resuming its trend.

15.Identifying Fair Value Gaps and Inefficiencies in the Market

Fair value gaps (FVGs) are price gaps between two candles where no trading occurred. They represent inefficiencies that the market often seeks to fill.

Key Points:

▫ FVGs are created by institutional traders during rapid price movements.

▫ They act as potential reversal zones.

Example in Rupees:

▫ The price moves like this:

▫ Candle 1 closes at ₹500, Candle 2 opens at ₹520, and Candle 3 opens at ₹540.

▫ The gap between ₹520 and ₹540 is an FVG. Later, the price may return to ₹520–₹540 before continuing upward.

16.Identifying Imbalances in Candlestick Sequences

Imbalances in candlestick sequences occur when price action leaves gaps due to one-sided trading activity. These imbalances are key zones for smart money to target.

Key Points:

▫ Imbalances indicate areas where the price moved too quickly.

▫ These areas often act as magnets for future price action.

Example in Rupees:

▫ A stock's price jumps from ₹1,000 to ₹1,100 within two candlesticks, leaving a gap between ₹1,020 and ₹1,050.

▫ Smart money might target this gap as a potential entry or exit zone.

17.Trading Imbalances and Identifying Opportunities

Trading imbalances means using areas of inefficiency in the market as opportunities for trades. Imbalances often lead to price corrections or reversals.

Key Points:

▫ Imbalances often occur near support/resistance or trendline breaks.

▫ Traders wait for the price to return to the imbalance before entering.

Example in Rupees:

▫ The price moves from ₹800 to ₹900 rapidly, leaving a gap at ₹850–₹870.

▫ Smart money may wait for the price to retrace to ₹860 (within the gap) before buying and pushing the price higher.

18.Understanding Buy-Side and Sell-Side Liquidity Zones

Liquidity zones are areas where a large number of pending buy or sell orders exist.

Buy-side liquidity: Above the current price, where stop-loss orders for short positions are placed.

Sell-side liquidity: Below the current price, where stop-loss orders for long positions are placed.

Key Points:

▫ Smart money manipulates price into these zones to collect liquidity.

▫ These zones are crucial for identifying potential reversals or continuations.

Example in Rupees:

▫ A stock is trading at ₹1,000:

▫ Buy-side liquidity is above ₹1,050, where stop-losses for short-sellers are placed.

▫ Sell-side liquidity is below ₹950, where stop-losses for buyers are placed.

▫ Smart money pushes the price to ₹1,060 (triggering buy-side liquidity), then reverses back below ₹1,000.

19.Liquidity Sweeps and Institutional Trading

A liquidity sweep occurs when smart money intentionally moves the price into liquidity zones to execute large trades.

Key Points:

▫ Liquidity sweeps are often followed by strong reversals.

▫ Institutions exploit retail stop-loss orders for better entry prices.

Example in Rupees:

▫ Nifty is trading at 18,000. Retail traders place stop-loss orders below 17,900.

▫ Smart money pushes the index to 17,880, sweeping sell-side liquidity, and then drives it up to 18,200.

20.Major Bullish and Bearish Market Structures

Bullish market structure: Higher highs and higher lows.

Bearish market structure: Lower highs and lower lows.

Key Points:

▫ These structures are essential for identifying market trends.

▫ Major structures guide long-term trades, while minor structures help in intraday or swing trades.

Example in Rupees:

▫ Bullish: ₹1,000 → ₹1,200 → ₹1,100 → ₹1,400 → ₹1,300 → ₹1,500.

▫ Bearish: ₹1,500 → ₹1,400 → ₹1,450 → ₹1,300 → ₹1,350 → ₹1,200.

21.Liquidity Imbalance and Manipulation in Trading

Liquidity imbalance occurs when one side (buy or sell) dominates, leading to rapid price moves. Smart money manipulates these imbalances for profit.

Key Points:

▫ Imbalances often result in price corrections.

▫ Retail traders get trapped by sudden movements.

Example in Rupees:

▫ A stock surges from ₹500 to ₹600 rapidly, leaving a gap between ₹520 and ₹550.

▫ Smart money may use this imbalance to push the price back to ₹540 before resuming the upward trend.

22.Market Movement Based on Liquidity Absorption

Smart money absorbs liquidity from retail traders by targeting stop-loss orders and limit orders to build their positions.

Key Points:

▫ Absorption occurs at key levels like support, resistance, or trendlines.

▫ It creates opportunities for large directional moves.

Example in Rupees:

The price of a stock is ₹1,200. Retail traders place stop-loss orders below ₹1,180. Smart money pushes the price to ₹1,170, absorbs liquidity, and then drives it back to ₹1,250.

23.Key Liquidity Zones for Market Reversals

Key liquidity zones are areas where significant buying or selling activity is expected, often leading to reversals.

Key Points:

▫ These zones are often around support/resistance or psychological levels (e.g., ₹500, ₹1,000).

▫ Smart money targets these zones to execute trades.

Example in Rupees:

A stock trades at ₹1,500, with a key liquidity zone at ₹1,450. Smart money may push the price down to ₹1,440, triggering stop-losses, before reversing it to ₹1,600.

24.Understanding Inducements in Smart Money Concepts

Inducements are traps set by smart money to lure retail traders into the market before reversing the price.

Key Points:

▫ Inducements often occur near support/resistance or trendlines.

▫ They are designed to trigger retail stop-loss orders.

Example in Rupees:

A stock is consolidating between ₹1,000 and ₹1,200. Retail traders place stop-loss orders above ₹1,200, assuming it's resistance. Smart money pushes the price to ₹1,220, collects liquidity, and then reverses back to ₹1,000.

25.Order Flow and Order Blocks

Order flow: The movement of institutional orders that drive the market.

Order blocks: Price areas where smart money accumulates or distributes positions.

Key Points:

▫ Order blocks act as support or resistance zones.

▫ Valid order blocks are often near liquidity zones or imbalances.

Example in Rupees:

The price of a stock falls from ₹1,000 to ₹950, then consolidates between ₹950–₹970. This consolidation is an order block, and the price may rise back to ₹1,050 after accumulating buy orders.

26.Identifying Bullish and Bearish Order Blocks

Bullish order blocks: Form before upward moves and act as support zones.

Bearish order blocks: Form before downward moves and act as resistance zones.

Example in Rupees:

▫ Bullish Order Block: The price falls to ₹1,000, consolidates, and then rises to ₹1,200. The consolidation zone near ₹1,000 is the bullish order block.

▫ Bearish Order Block: The price rises to ₹1,500, consolidates, and then falls to ₹1,300. The consolidation zone near ₹1,500 is the bearish order block.

27.Understanding Fair Value Gap (FVG) Inversion

FVG inversion occurs when the market revisits a fair value gap and reverses its role (e.g., from support to resistance).

Key Points:

FVG inversions are critical for confirming trend changes.

Example in Rupees:

A stock surges from ₹500 to ₹600, leaving a gap at ₹520–₹550. If the price later revisits ₹540 and rejects it, this confirms an FVG inversion and a potential trend reversal.

28.Identifying Liquidity Zones for Market Reversals

Liquidity zones are areas where clusters of buy or sell orders are concentrated. These zones often indicate potential reversals because institutional traders use them to execute large orders.

Key Concepts:

▫ Buy-Side Liquidity Zones: Found above recent highs where stop-losses from sellers (short positions) are placed.

▫ Sell-Side Liquidity Zones: Found below recent lows where stop-losses from buyers (long positions) are placed.

How They Work:

▫ Smart money drives the price into these zones to sweep liquidity (trigger stop-losses) and creates a sharp reversal.

▫ Liquidity zones act as magnets because they provide the volume needed for institutional orders.

Example in Rupees:

▫ Imagine HDFC Bank stock is trading between ₹1,600 and ₹1,800. Retail traders assume ₹1,800 is resistance and place sell orders above it, with stop-losses near ₹1,810.

▫ Smart money pushes the price to ₹1,820, triggering buy-side liquidity, then reverses the price sharply to ₹1,750. This liquidity sweep gives smart money an opportunity to sell at premium levels.

29.Understanding Internal Liquidity at Major Swing Lows

Internal liquidity refers to the collection of stop-loss orders and pending trades that accumulate within a market's internal structure, such as swing highs and swing lows.

Key Concepts:

▫ Swing High: A peak in price action, marking a local high.

▫ Swing Low: A trough in price action, marking a local low.

How They Work:

▫ Institutional traders target swing lows (internal liquidity) to collect stop-losses from retail traders before moving the price higher.

▫ This process often results in false breakouts or sharp reversals.

Example in Rupees:

▫ A stock moves as follows: ₹1,000 → ₹1,200 → ₹1,100 → ₹1,300.

▫ The swing low at ₹1,100 holds internal liquidity. Smart money pushes the price below ₹1,100 (to ₹1,090) to trigger stop-loss orders. Then, they drive the price back up to ₹1,400.

30.Smart Money Absorbs Retail Liquidity for Advantageous Buying Positions

Smart money (institutional traders) manipulates the market to absorb retail traders' liquidity. By targeting stop-losses and pending orders, they ensure enough volume to enter or exit positions.

Key Concepts:

▫ Retail Liquidity: Created by retail traders placing stop-losses, limit orders, and market orders at predictable levels.

▫ Absorption: Smart money drives the price to these levels to fill their large orders.

Example in Rupees:

▫ A stock is trading at ₹500, and retail traders place stop-losses below ₹480.

▫ Smart money deliberately pushes the price to ₹470, collects stop-losses, and buys heavily at ₹470.

▫ Once their positions are filled, the price is pushed back to ₹550.

31.Price Manipulation Around Support and Resistance Levels

Price manipulation occurs when institutional traders intentionally break key support or resistance levels to trap retail traders and create liquidity.

How It Happens:

Support Manipulation:

▫ Retail traders buy at support (e.g., ₹1,000) with stop-losses below it.

▫ Smart money pushes the price below ₹1,000, collects stop-losses, and then reverses upward.

Resistance Manipulation:

▫ Retail traders sell at resistance (e.g., ₹1,200) with stop-losses above it.

▫ Smart money pushes the price above ₹1,200 to trigger stop-losses, then reverses downward.

Example in Rupees:

▫ A stock consolidates between ₹1,000 (support) and ₹1,200 (resistance).

▫ Smart money pushes the price to ₹980 (breaking support) and then reverses it to ₹1,300.

32.Understanding Inducements and Smart Money Concepts

Inducements are traps set by smart money to manipulate retail traders into taking positions, which creates liquidity for institutional orders.

How It Works:

▫ Retail traders are induced into thinking the market will break out or trend, leading them to enter positions prematurely.

▫ Smart money reverses the price, forcing retail traders to exit at a loss.

Example in Rupees:

▫ A stock moves from ₹1,000 to ₹1,100, creating a bullish trend. Retail traders expect the breakout to continue and buy aggressively at ₹1,120.

▫ Smart money induces this behavior, reverses the price to ₹1,050, collects stop-losses, and then drives it back to ₹1,200.

33.Inducement Levels and Liquidity Traps

Inducement levels are specific price points used by smart money to lure retail traders into the market. Liquidity traps are setups where retail traders lose money due to false breakouts or rapid reversals.

How to Identify Inducement Levels:

▫ Look for areas of consolidation before sharp price moves.

▫ Note significant support/resistance levels where retail traders tend to place orders.

Example in Rupees:

▫ A stock consolidates between ₹800 and ₹1,000. Retail traders expect a breakout above ₹1,000 and place buy orders.

▫ Smart money pushes the price to ₹1,020 (inducing buying), then reverses it sharply to ₹900.

34.Order Blocks and How They Drive Market Structure

Order blocks are zones where institutional traders place large buy or sell orders. They represent the footprints of smart money and often precede major price movements.

Key Concepts:

▫ Bullish Order Block: Found before upward price moves, acting as support.

▫ Bearish Order Block: Found before downward price moves, acting as resistance.

How to Trade Order Blocks:

▫ Identify large consolidations or imbalances.

▫ Look for price revisits to these zones.

▫ Confirm with other indicators (e.g., liquidity sweeps or break of structure).

Example in Rupees:

A stock moves from ₹1,000 to ₹1,200, consolidates at ₹1,100, then moves to ₹1,400. The zone at ₹1,100 is a bullish order block. When the price revisits ₹1,100, traders can expect a bounce to ₹1,500.

35.Fair Value Gaps, Imbalances, and Price Reactions

Fair value gaps (FVGs) and imbalances are price gaps caused by strong buying or selling. These areas are revisited by the market for price corrections or trend continuations.

Key Concepts:

▫ FVGs occur when one candlestick closes far from the next.

▫ Smart money uses these gaps to enter or exit trades.

Example in Rupees:

Price moves from ₹500 to ₹600, leaving a gap between ₹520 and ₹540. The market revisits ₹530 to fill the gap, offering traders a chance to enter.

36.Identifying and Trading Liquidity Voids

Liquidity voids are large price gaps caused by one-sided trading (e.g., a strong uptrend or downtrend). These voids often act as magnets for price.

Example in Rupees:

Nifty surges from 18,000 to 18,500, leaving a gap at 18,200–18,300. Traders can anticipate the price returning to 18,250 before continuing its trend.

37.Understanding Breaker Blocks and Mitigation Blocks for Trading Opportunities

Breaker Block: A zone where the market breaks through a level of support or resistance, but then the same zone acts as a pivot for reversals or continuations.

Mitigation Block: A level where price retraces to mitigate or revisit unfilled institutional orders.

Key Concepts:

Breaker Blocks: Usually form after liquidity sweeps. Act as a strong reversal or continuation point.

Mitigation Blocks: These zones allow smart money to balance their books by revisiting areas with pending orders.

Example in Rupees:

Breaker Block: A stock moves from ₹500 to ₹700 but quickly reverses to ₹600. The ₹600–₹620 zone becomes a breaker block because it acts as resistance-turned-support for the next rally to ₹750.

Mitigation Block: A stock surges from ₹1,000 to ₹1,500. Before continuing higher, it retraces to ₹1,200 to fill pending buy orders, making ₹1,200 a mitigation block.

38.Differentiate Breaker Blocks and Mitigation Blocks

Key Differences:

Breaker Block:

▫ Triggered after liquidity sweeps.

▫ Represents a structural change in the market.

Mitigation Block:

▫ Revisits price levels where unfilled orders exist.

▫ Ensures order book balance before continuation.

39.Identifying Bearish Breaker Blocks

A bearish breaker block forms when price breaks below a support level, then uses the same level as resistance for a continued downtrend.

Example in Rupees:

▫ A stock falls from ₹1,000 to ₹800, retraces to ₹900, and continues falling to ₹700.

▫ The ₹880–₹900 zone becomes a bearish breaker block where resistance forms.

40.Rejection Blocks for Trend Reversals

Rejection blocks are areas where price attempts to break a level but fails, signaling a potential reversal.

Key Concepts:

▫ Rejection blocks act as zones for significant reversals in trends.

▫ They occur near key psychological levels (e.g., ₹1,000, ₹2,000).

Example in Rupees:

A stock tries to break above ₹1,500 but closes below ₹1,480. This creates a rejection block, signaling a reversal back to ₹1,400.

41.Displacement and Fair Value Gaps (FVG)

▫ Displacement: A strong, sudden move in the market caused by imbalance in buying or selling pressure.

▫ Fair Value Gap (FVG): A gap left between two candlesticks due to a sharp price move.

Key Points:

▫ FVGs act as zones for price retracement or continuation.

▫ Smart traders use these gaps to identify high-probability entry points.

Example in Rupees:

▫ A stock surges from ₹400 to ₹500 in a single candlestick, leaving a gap between ₹420 and ₹450.

▫ The price revisits ₹430 to fill the gap before continuing to ₹550.

42.Liquidity Voids and Vacuum Blocks

▫ Liquidity Void: A rapid price move that leaves no significant consolidation or trading activity.

▫ Vacuum Block: A zone within a liquidity void where price is likely to return.

Key Concepts:

▫ Liquidity voids occur during high-impact news or major institutional moves.

▫ Vacuum blocks are revisited to fill orders and balance the market.

Example in Rupees:

▫ The market jumps from ₹10,000 to ₹10,500 in a single day, leaving a void between ₹10,200 and ₹10,300.

▫ Later, the price retraces to ₹10,250, filling the void.

43.Premium and Discount Zones Using Fibonacci

▫ Premium Zone: The upper portion of a price range, considered overvalued and ideal for selling.

▫ Discount Zone: The lower portion of a price range, considered undervalued and ideal for buying.

Steps to Identify Zones:

▫ Draw a Fibonacci retracement from the recent high to the recent low.

▫ Premium Zone: Above the 50% level.

▫ Discount Zone: Below the 50% level.

Example in Rupees:

▫ A stock moves from ₹1,000 to ₹800. Using Fibonacci:

▫ 50% retracement is ₹900.

▫ Premium Zone: ₹900–₹1,000 (good for selling).

▫ Discount Zone: ₹800–₹900 (good for buying).

44.Understanding Supply and Demand Zones

▫ Supply Zone: An area where selling pressure is strong enough to reverse an uptrend.

▫ Demand Zone: An area where buying pressure is strong enough to reverse a downtrend.

How to Identify:

▫ Look for areas of consolidation before a major move.

▫ Zones often align with institutional orders.

Example in Rupees:

▫ Supply Zone: Price surges from ₹500 to ₹600 but reverses from ₹590, indicating a supply zone.

▫ Demand Zone: Price drops to ₹800 but rallies from ₹810, indicating a demand zone.

45.Fibonacci Retracement for Trade Entries

Fibonacci retracement is a tool to identify potential support/resistance levels within a trend.

Steps to Use:

▫ Identify a significant high and low.

▫ Draw Fibonacci from high to low.

▫ Look for key levels (23.6%, 38.2%, 50%, 61.8%, 78.6%).

Example in Rupees:

▫ A stock drops from ₹1,200 to ₹800. Key retracement levels are:

▫ 38.2%: ₹960

▫ 50%: ₹1,000

▫ 61.8%: ₹1,040

▫ Traders may enter long positions near ₹960 or ₹1,000, expecting a reversal.

46.Understanding the Flip Pattern in Trading

The flip pattern occurs when a previous supply zone transitions into a demand zone (or vice versa). This is an indication of a trend reversal or strong continuation.

Key Concepts:

Supply to Demand Flip: Happens during bullish reversals. A previous resistance becomes support.

Demand to Supply Flip: Happens during bearish reversals. A previous support becomes resistance.

Example in Rupees:

Supply to Demand Flip: A stock rises from ₹1,000 to ₹1,200, retraces to ₹1,100 (resistance turned support), then rallies to ₹1,400. The ₹1,100 level is the flip zone.

Demand to Supply Flip: A stock drops from ₹1,500 to ₹1,200, retraces to ₹1,300 (support turned resistance), then falls to ₹1,000. The ₹1,300 level is the flip zone.

47.Identifying Supply and Demand Zones for Trading Strategies

Supply and demand zones represent areas where institutional traders place large buy or sell orders, causing price reversals or continuations.

How to Identify:

▫ Look for strong price moves (impulses) following consolidation.

▫ The consolidation area before the move is the supply/demand zone.

Example in Rupees:

Demand Zone: A stock consolidates at ₹800–₹820 and then surges to ₹1,000. The ₹800–₹820 range becomes a demand zone.

Supply Zone: A stock consolidates at ₹1,200–₹1,220 and then drops to ₹1,000. The ₹1,200–₹1,220 range becomes a supply zone.

48.Rules for Valid Flip Patterns and Zones

For a flip pattern or zone to be valid, it must meet specific criteria ensuring reliability.

Key Rules:

Strong Impulse: Must follow a significant move up or down.

Tested Zone: Price should revisit the zone for validation.

Confluence: Align with other SMC concepts (e.g., liquidity sweeps, order blocks).

Example in Rupees:

A stock moves from ₹1,000 to ₹1,300, then retraces to ₹1,200 (flip zone) and rallies to ₹1,500. If the price reacts positively to ₹1,200 multiple times, it validates the flip zone.

49.Understanding Breaker Blocks and Unicorn Setups

Breaker Block: A reversal zone after a liquidity sweep.

Unicorn Setup: A high-probability trade setup combining multiple confluences (e.g., order blocks, FVG, and breaker blocks).

Example in Rupees:

A stock falls from ₹1,000 to ₹800, breaks below ₹780 (liquidity sweep), and reverses back above ₹820. The ₹800–₹820 zone is a breaker block. In a unicorn setup, this breaker block aligns with a demand zone and a fair value gap, offering a strong buy signal.

50.Rejection Blocks for Trend Reversals

Rejection blocks are zones where price attempts to break a level but fails, signaling potential reversals.

How to Use:

▫ Look for strong wicks or rejections near key levels.

▫ Confirm with volume or other SMC tools.

Example in Rupees:

A stock tries to break above ₹1,200 multiple times but closes below ₹1,180 each time. This creates a rejection block, indicating a possible reversal to ₹1,100.

51.Trading Liquidity Voids

Liquidity voids are large price gaps caused by imbalances in buying or selling pressure. These voids often attract price back to fill the gap.

Example in Rupees:

A stock jumps from ₹1,000 to ₹1,200 in one day, leaving a void between ₹1,050 and ₹1,100. Later, the price retraces to ₹1,070 to fill the void before continuing to ₹1,300.

52.Understanding Institutional Candles

Institutional candles are large candlesticks created by smart money to manipulate price and capture liquidity.

Key Points:

▫ They often align with liquidity sweeps or imbalances.

▫ The body of the candle (open to close) shows the direction of institutional intent.

Example in Rupees:

A stock drops from ₹1,500 to ₹1,200 in a single large bearish candle. This could represent institutional selling, especially if it sweeps stop-losses above ₹1,520 before the drop.

53.Identifying Fair Value Gap Inversion

Fair Value Gap (FVG) inversion occurs when a gap that was previously filled flips to act as a new support or resistance level.

Example in Rupees:

A gap forms between ₹900 and ₹950, and price fills it. Later, the ₹950 level becomes support, pushing the price to ₹1,100.

54.Using Fibonacci Retracement Levels for Trades

Fibonacci retracement helps identify premium and discount zones for buying or selling.

Key Levels: 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Example in Rupees:

A stock moves from ₹500 to ₹1,000.

▫ 38.2% retracement: ₹810

▫ 50% retracement: ₹750

▫ 61.8% retracement: ₹690

▫ Traders may look to buy near ₹750 or ₹690 for a continuation to ₹1,200.

55.Premium and Discount Zones

Premium Zone: Overvalued, ideal for selling.

Discount Zone: Undervalued, ideal for buying.

Example in Rupees:

▫ A stock moves from ₹2,000 to ₹1,000.

▫ Premium Zone: Above ₹1,500 (ideal for selling).

▫ Discount Zone: Below ₹1,500 (ideal for buying).

56.Understanding Inducement Levels

Inducement levels are traps set by smart money to lure retail traders into the market and collect liquidity.

Example in Rupees:

A stock consolidates at ₹800. Retail traders expect a breakout and buy at ₹820. Smart money induces this behavior, reverses to ₹780, and then moves to ₹900.

57.Understanding Liquidity Pools

Liquidity pools are zones where stop-loss orders, pending buy/sell orders, or large institutional positions are clustered. These areas act as magnets for price.

Key Types of Liquidity Pools:

Buy-side Liquidity: Above resistance levels where stop-losses of short sellers are placed.

Sell-side Liquidity: Below support levels where stop-losses of buyers are placed.

Example in Rupees:

A stock consolidates between ₹950 and ₹1,000. Retail traders place stop-loss orders:

Buy-side Liquidity: Above ₹1,000 (stop-loss of short positions).

Sell-side Liquidity: Below ₹950 (stop-loss of long positions).

Smart money sweeps these zones to execute large orders, e.g., price spikes to ₹1,020, then reverses to ₹930.

58.Smart Money's Role in Market Manipulation

Smart money refers to institutional investors or entities with significant capital. They manipulate price to fill large orders at favorable prices by creating fake breakouts, liquidity sweeps, or inducement traps.

Key Manipulation Techniques:

▫ Liquidity Sweep: Pushing the price to hit stop-losses and collect liquidity.

▫ False Breakout: Price breaks key levels to trap retail traders before reversing.

Example in Rupees:

A stock has resistance at ₹1,200. Smart money pushes the price to ₹1,220, triggering stop-losses. After trapping buyers, they reverse the price to ₹1,150.

59.Institutional Order Flow

Institutional order flow represents large-scale buy/sell activity that causes major price movements. These flows create visible patterns like order blocks or liquidity voids.

How to Identify:

▫ Strong impulsive moves followed by retracements.

▫ Large candlestick patterns with minimal wicks.

Example in Rupees:

A stock jumps from ₹500 to ₹800 due to heavy institutional buying. The retracement to ₹600 fills pending orders, allowing the price to resume its rally to ₹900.

60.Understanding Internal and External Liquidity

Internal Liquidity: Liquidity within a consolidation range (minor highs/lows).

External Liquidity: Liquidity outside the consolidation range (major swing highs/lows).

Example in Rupees:

▫ A stock consolidates between ₹700 and ₹800:

▫ Internal Liquidity: Stop-losses at ₹720 or ₹780.

▫ External Liquidity: Swing high at ₹820 and swing low at ₹680.

▫ Smart money often targets external liquidity first before reversing to internal levels.

61.Order Blocks in Detail

Order blocks are zones where institutional traders accumulate or distribute large orders, leading to significant price moves.

How to Identify:

▫ Look for a large bullish or bearish candlestick before a reversal.

▫ Validate the zone with a fair value gap or liquidity sweep.

Example in Rupees:

A stock falls from ₹1,000 to ₹900 after forming a bearish order block at ₹950–₹970. The price later retraces to ₹960 (order block) before continuing to ₹850.

62.Breaker Blocks vs. Order Blocks

Key Difference:

▫ Order Blocks: Form before a price move and are revisited during retracements.

▫ Breaker Blocks: Form after liquidity sweeps and signal trend reversals.

Example in Rupees:

A stock falls from ₹800 to ₹600 after breaking a support at ₹700 (breaker block). The retracement to ₹690 offers a selling opportunity.

63.Mitigation Candles

Mitigation candles are revisited by price to fill unfilled institutional orders left during impulsive moves.

Example in Rupees:

A stock jumps from ₹500 to ₹800, leaving an imbalance at ₹600–₹650. Price later revisits ₹620 to mitigate the imbalance before moving to ₹900.

64.Fair Value Gap (FVG) Trading Strategy

A Fair Value Gap (FVG) is the area between the high of one candle and the low of another, created due to sharp price movements.

How to Trade:

▫ Identify FVGs in trending markets.

▫ Wait for price to revisit the gap for entries.

Example in Rupees:

A stock jumps from ₹300 to ₹400, leaving a gap between ₹340 and ₹360. Price retraces to ₹350, creating a buy entry with a target of ₹450.

65.Liquidity Voids in Trending Markets

A liquidity void is an area where price moves quickly without significant trading activity.

How to Use:

Look for retracements into the void for trade setups.

Example in Rupees:

A stock surges from ₹1,000 to ₹1,500 in one day, leaving a void at ₹1,200–₹1,300. Price retraces to ₹1,250 before continuing to ₹1,700.

66.Institutional Manipulation Candles

Institutional candles represent large moves created by smart money to manipulate price and capture liquidity.

Example in Rupees:

A stock falls sharply from ₹2,000 to ₹1,800 in one large bearish candle after sweeping liquidity above ₹2,050. This manipulation captures stop-losses and triggers retail selling.

67.Using Fibonacci for Advanced Entry Zones

Fibonacci retracement levels identify premium (sell) and discount (buy) zones.

Steps to Apply:

▫ Identify the swing high and low.

▫ Mark levels: 38.2%, 50%, 61.8%, and 78.6%.

▫ Use confluence with order blocks or liquidity zones.

Example in Rupees:

▫ A stock moves from ₹1,000 to ₹500. Retracement levels are:

▫ 38.2%: ₹690

▫ 50%: ₹750

▫ 61.8%: ₹810

▫ Enter at ₹750 (discount zone) for a target of ₹900.

With this, all the topics of Smart Money Concept have been covered. I hope you understand everything, and if anything still feels confusing, you can also learn about each topic through video lectures available completely free.