Crypto Market Learning Index

Complete guide to master cryptocurrency trading

Foundation Concepts

Advanced Trading

ALL ABOUT SUPPORT AND RESISTANCE

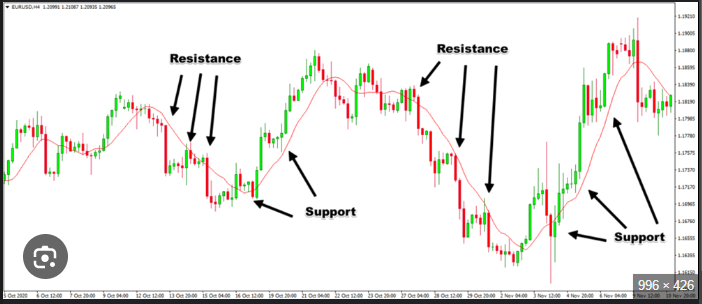

What is Support and Resistance

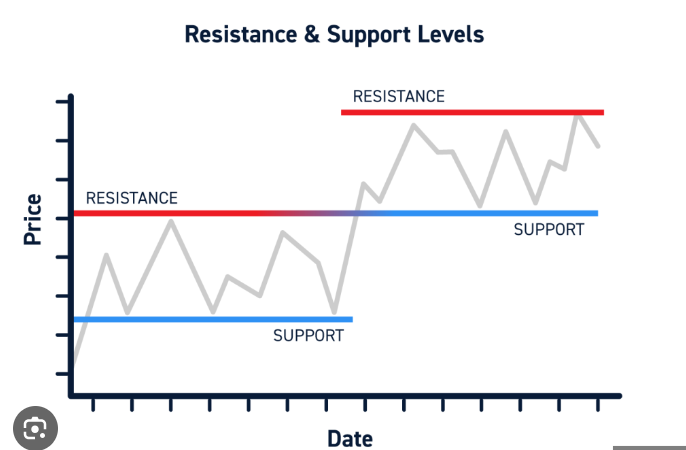

Support and Resistance are key concepts in technical analysis of financial markets, used to identify price levels where a stock, cryptocurrency, or other asset tends to reverse or pause its trend. Prices move because of supply and demand. When demand is greater than supply, prices rise. When supply is greater than demand, prices fall. Sometimes, prices will move sideways as both supply and demand are in equilibrium.

Like many concepts in technical analysis, the explanation and rationale behind technical concepts are relatively easy, but mastery in their application often takes years of practice.

Support

A price level where an asset tends to stop falling and may bounce back upwards. This happens because demand (buying interest) increases, outweighing supply.

Key Points:

- • Acts as a "floor" for the price

- • Often formed at historical low points, psychological levels, or areas where significant buying activity occurred in the past

- • When the price approaches support, traders may see it as a buying opportunity

Resistance

A price level where an asset tends to stop rising and may reverse downwards. This happens because supply (selling interest) increases, outweighing demand.

Key Points:

- • Acts as a "ceiling" for the price

- • Often formed at historical high points or areas where significant selling activity occurred in the past

- • When the price approaches resistance, traders may see it as a selling opportunity

Example:

Suppose a stock consistently drops to ₹50 but then rises, so ₹50 is a support level. If the same stock struggles to rise above ₹100 and falls back, so ₹100 is a resistance level.

Once an area or "zone" of support or resistance has been identified, those price levels can serve as potential entry or exit points because, as the price reaches a point of previous support or resistance, it will do one of two things: bounce back away from the support or resistance level, or violate the price level and continue in its prior direction—until it hits the next support or resistance level.

The timing of some trades is based on the belief that support and resistance zones will not be broken. Whether the price is halted by or breaks through the support or resistance level, traders can "bet" on the direction of price and can quickly determine if they are correct. If the price moves in the wrong direction (breaks through prior support or resistance levels), the position can be closed at a small loss. If the price moves in the right direction (respects prior support or resistance levels), however, the move may be substantial.

How They Work

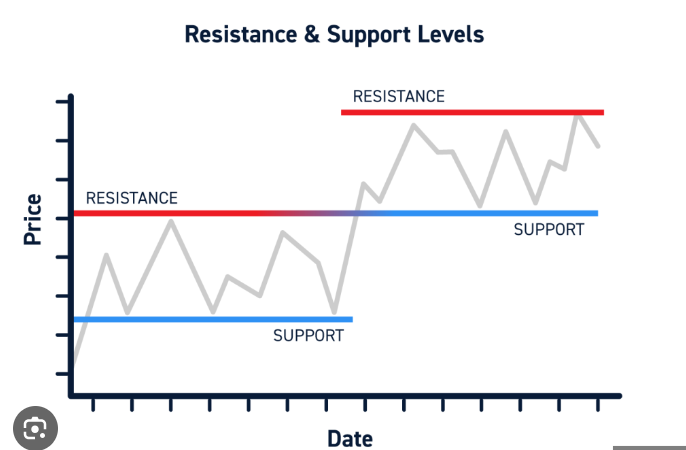

Trend Reversal

If the price struggles to break support and resistance, it might reverse direction.

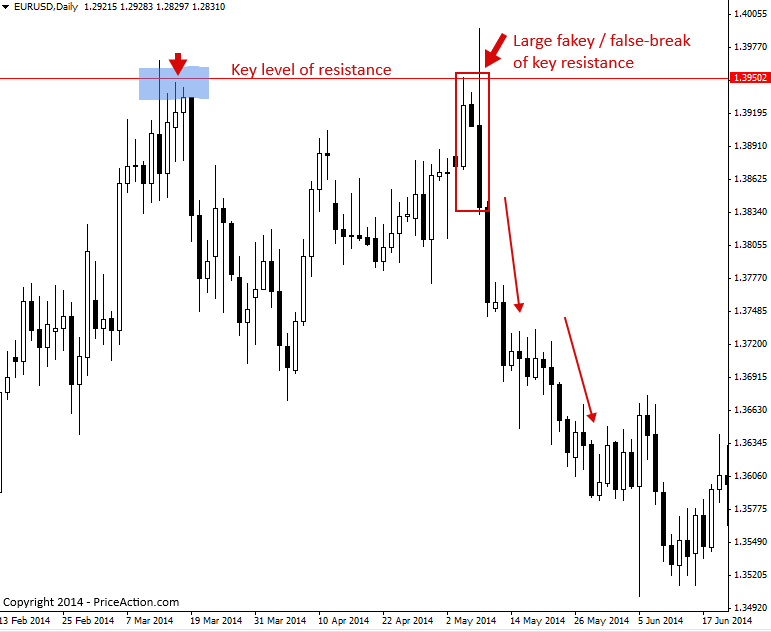

Breakouts

When the price breaks through support or resistance, it often indicates strong momentum in that direction.

Role Reversal

Once a resistance level is broken, it may become a support level (and vice versa).

Use in Trading

Traders use support and resistance levels to:

- • Determine entry and exit points

- • Set stop-loss and take-profit orders

- • Assess the strength of a trend

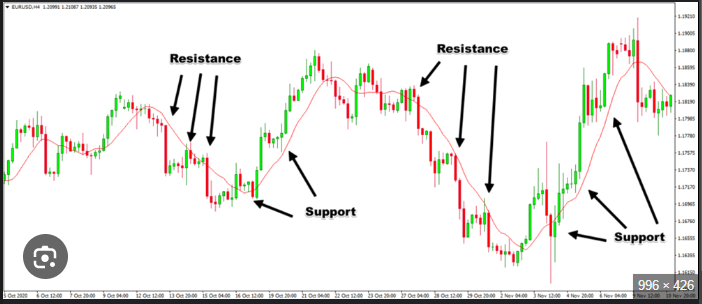

How to Draw Error-less 100% Accurate Support and Resistance

Why Use Support and Resistance Lines:

- • To get the context of the market

- • Better timing for your entries and exits

How to Draw Support and Resistance:

→ First define your time frame (for no particular time frame, you can always go with 15 min interval)

→ Select a pre-built indicator: Swing High Low (Indicator name)

→ You are allowed to cut through a wick but not through candle (but in some cases to join max lines you can adjust the line slightly and cut through candle also to join more candles)

→ Join maximum number of candles

→ Zoom out to at least 300 bars/candles

→ Draw trend lines that connect at least 2 major swing points

Market-Specific Approaches:

1. In Trending Market

Draw the 2 most recent swing points

2. In Range Market

Draw the highs and lows of the range (adjust it to get the most number of touches)

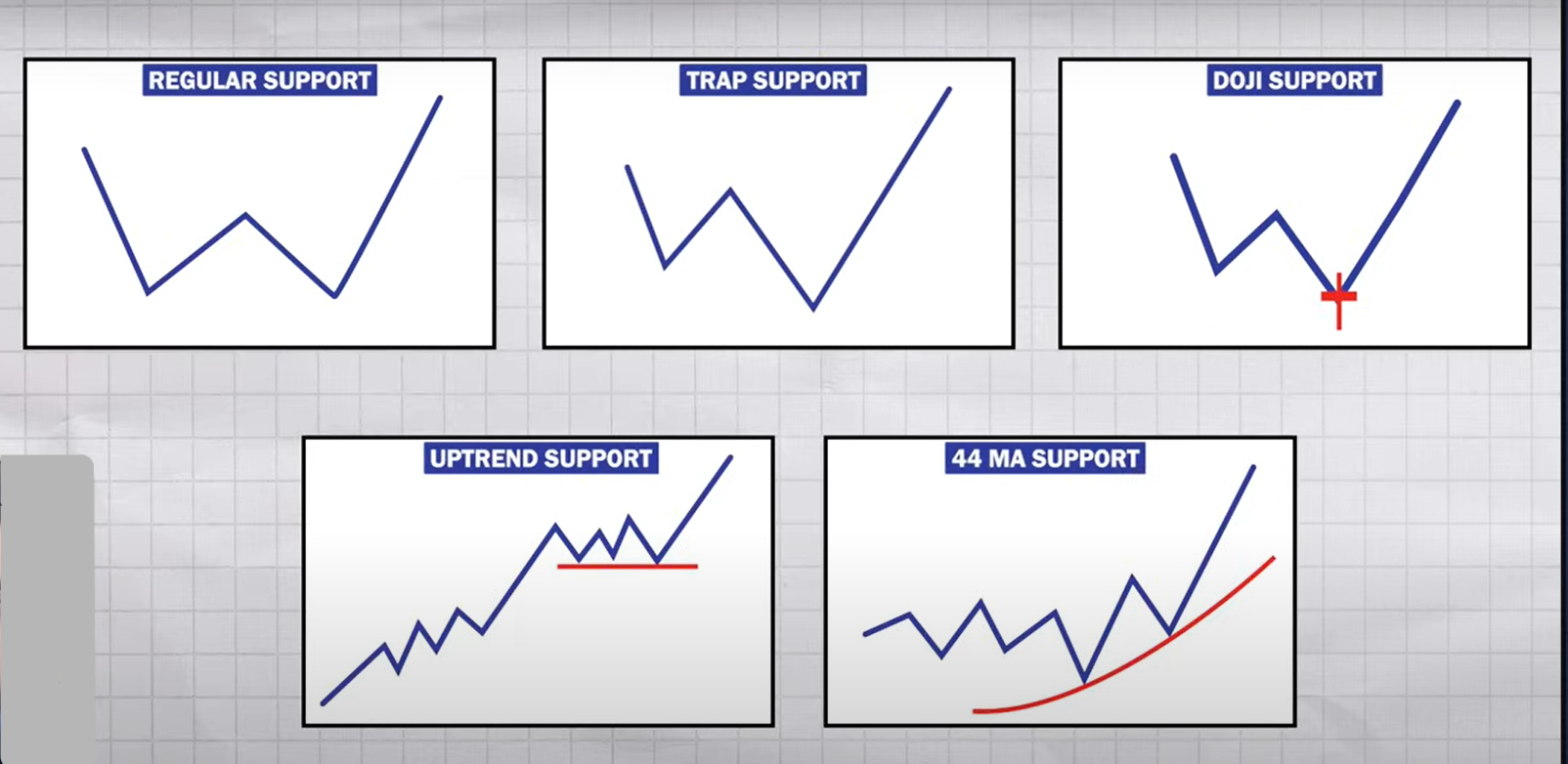

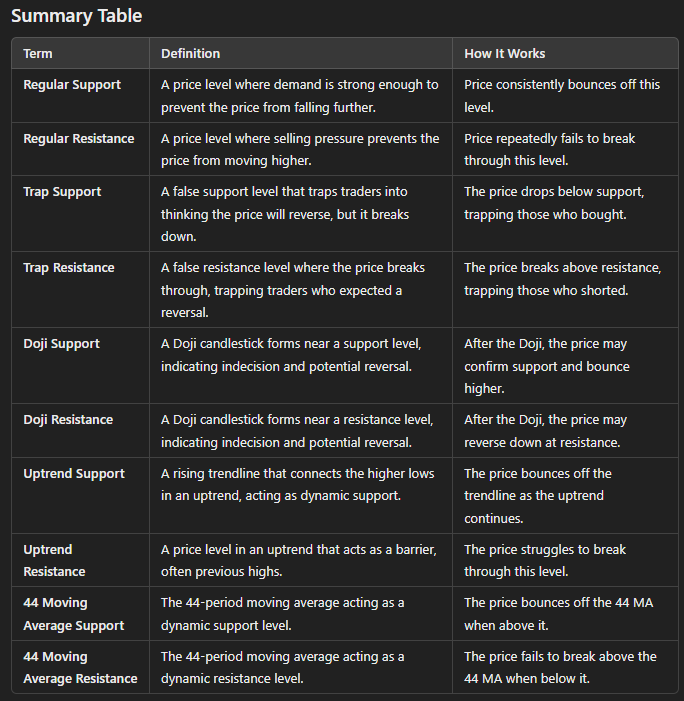

Top 5 Support and Resistance Types:

- • Regular Support

- • Trap Support

- • Doji Support

- • Uptrend Support

- • 44 Moving Avg. Support

TOP SUPPORT & RESISTANCE METHODS

Regular Support

Support is a price level at which a stock tends to find buying interest and where the price typically reverses after falling to that level. It acts as a 'floor' that prevents the price from declining further.

Example:

If a stock keeps bouncing at $50, $50 is considered a regular support level. It is a level where buyers are expected to step in and drive the price back up.

Regular Resistance

Resistance is the opposite of support. It is a price level where selling pressure exceeds buying interest, causing the price to reverse downwards. It acts as a 'ceiling' preventing the price from rising above it.

Example:

If a stock repeatedly fails to move above $100, then $100 is considered a regular resistance level.

Trap Support

Trap support occurs when the price seems to find support at a certain level, causing traders to believe the stock will reverse and go up. However, the price breaks below this level, trapping those who entered long positions.

Example:

A stock tests a support level at $50, and many traders buy at that level expecting a bounce. But instead of bouncing, the price breaks below $50, leading to more selling and trapping the traders who bought there.

Trap Resistance

Trap resistance occurs when a stock price hits a resistance level and many traders expect a price reversal down. However, the price breaks above the resistance, catching those traders who shorted the stock. It is a 'trap' because traders who expect the price to fall are caught off guard when the price breaks higher.

Example:

A stock struggles to break above $100 (acting as resistance), but suddenly it breaks above that level, causing a 'trap' for those who had shorted it at resistance.

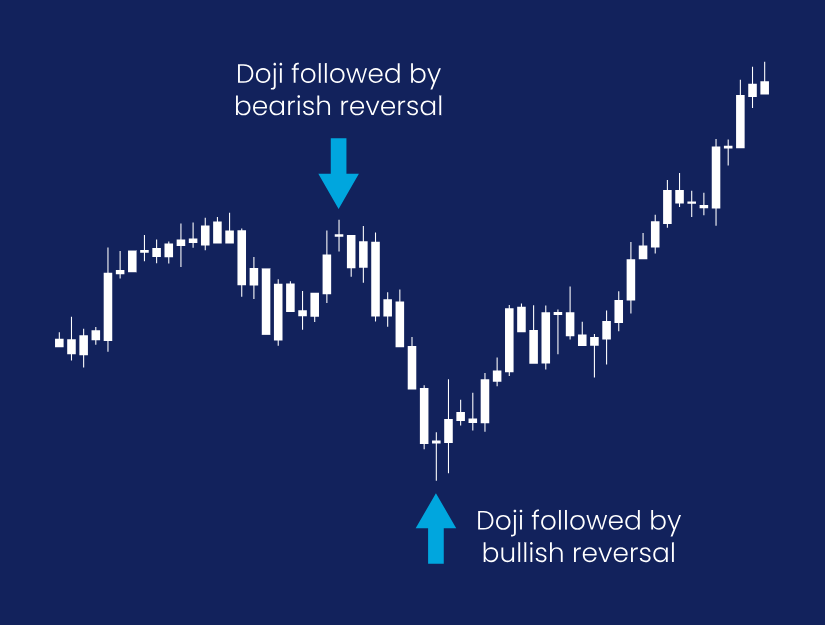

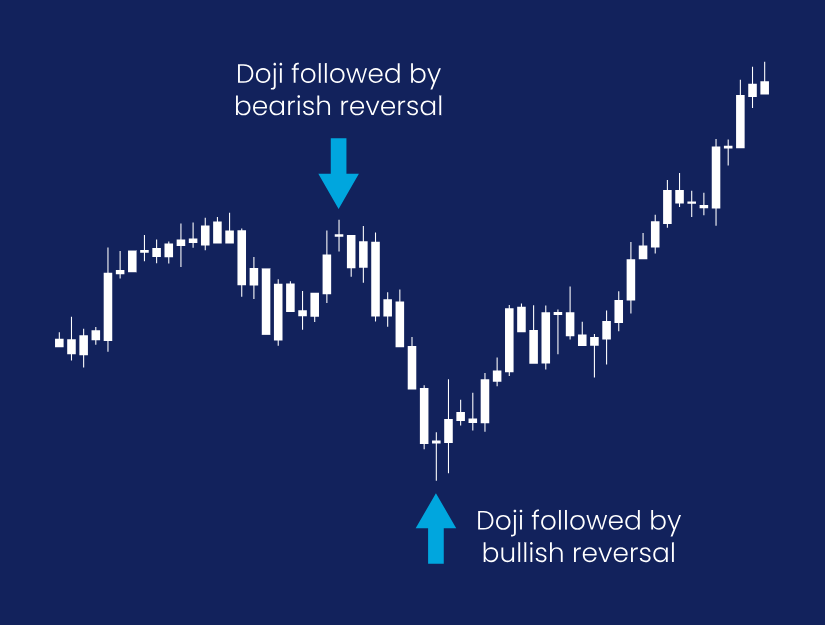

Doji Support

A Doji candlestick pattern, characterized by a small body and long upper and lower shadows, indicates indecision in the market. When a Doji appears at or near a support level, it can signal a potential reversal.

Example:

A Doji forms at a key support level (e.g., $50), followed by a bullish candle closing above the Doji. This could signal that the price will bounce from the support level.

Doji Resistance

When a Doji appears at a resistance level, it indicates indecision at the top of an uptrend. This can be a sign of potential reversal or exhaustion of upward momentum. A Doji at resistance can suggest that buyers are losing control, and a bearish confirmation candle may follow.

Example:

A Doji forms at $100, followed by a bearish candle, signaling that the resistance at $100 may hold and the price could reverse downward.

Uptrend Support

In an uptrend, support refers to the trendline drawn along the lows of the price action (higher lows). This uptrend support represents a rising level where buying interest tends to emerge, and it prevents the price from falling too far. It is a dynamic level that adjusts with time as the price moves higher.

Example:

In an uptrend, the price makes higher lows, and a trendline can be drawn connecting those lows. This trendline serves as uptrend support, and when the price tests this line, it may bounce higher if the trend is still intact.

Uptrend Resistance

Resistance in an uptrend is a price level that the stock finds difficult to break through, usually around previous highs. It is a level where selling pressure exceeds buying interest, causing a price pullback. Uptrend resistance can turn into support if the price breaks through it and continues higher.

Example:

If the stock price keeps hitting a resistance zone at $100 in an uptrend, that level might act as an obstacle until the price eventually breaks through it, turning $100 into new support.

44 Moving Average Support

A 44-period moving average can act as a dynamic support level when the price is above it. If the stock price approaches this moving average and bounces off it, the 44 MA is considered to be acting as support.

Example:

A stock is in an uptrend and keeps finding support around the 44-day moving average. When the price pulls back to the 44 MA and bounces higher, it confirms that the moving average is acting as support.

44 Moving Average Resistance

Similarly, the 44 MA can act as resistance when the price is below it. If the stock tries to move higher and approaches the 44 MA but fails to break through it, the moving average serves as resistance.

Example:

If a stock is in a downtrend and approaches the 44-day moving average but is unable to break above it, the moving average acts as resistance, pushing the price back down.

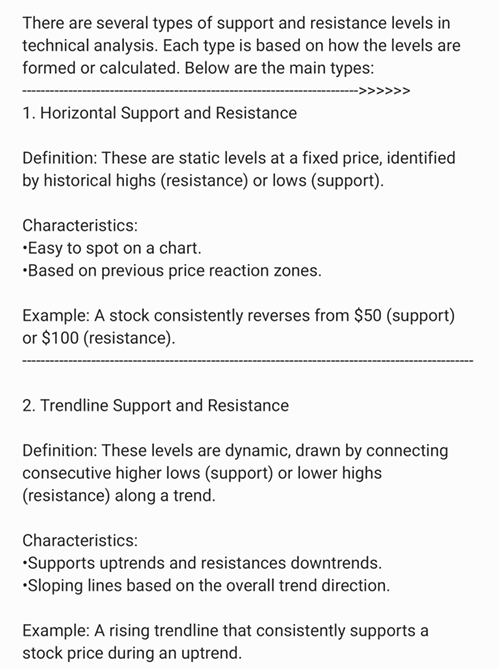

Important Types of Support and Resistance

Psychological Levels

Round numbers like ₹100, ₹500, ₹1000 often act as strong support/resistance.

Historical Levels

Previous highs and lows often serve as future support and resistance zones.

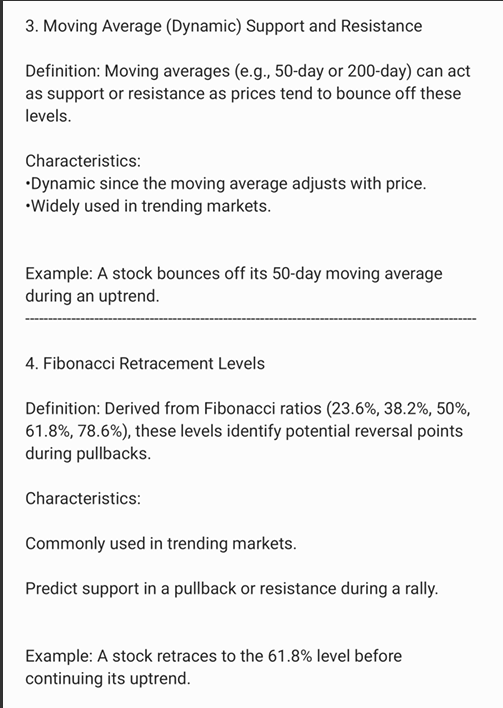

Moving Averages

Dynamic support/resistance that moves with price action over time.

Volume-Based Levels

Areas with high trading volume often become significant support/resistance.

Fibonacci Levels

Mathematical ratios that often coincide with natural support/resistance.

Trendlines

Diagonal support/resistance lines connecting swing highs or lows.

S&R Reliability Factors

- • Number of touches: More touches = stronger level

- • Time frame: Higher time frames = more significant

- • Volume: High volume at level = more reliable

- • Recent activity: Recent levels more relevant than old ones

Key Trading Points

- • Entry: Buy near support, sell near resistance

- • Stop Loss: Below support for longs, above resistance for shorts

- • Breakouts: Strong moves beyond S&R can signal trend changes

- • Confirmation: Wait for price action confirmation before trading