Crypto Market Learning Index

Complete guide to master cryptocurrency trading

Foundation Concepts

Advanced Trading

Options Trading

Option trading in the stock market is the combination of knowledge, strategy, discipline and risk management.

It is mainly of two types:

• Option Buying

• Option Selling

Before doing option trading you must know the terms and understanding the basics that can be useful for making profits...

Understanding the Basics

1. Understanding the Basics

Options Terminology: Know key terms like calls, puts, strike price, expiration date, premium, intrinsic value, and extrinsic value.

Options Pricing: Understand the factors affecting options pricing, including the Greeks (Delta, Gamma, Theta, Vega, and Rho).

2. Market Research

Fundamental Analysis: Study the underlying assets financials, industry trends, and macroeconomic indicators.

Technical Analysis: Use charts, patterns, and technical indicators to predict price movements.

Volatility Analysis: Monitor implied volatility (IV) and historical volatility to assess market sentiment and option premiums.

3. Strategy Development

Use specific strategies based on market conditions:

- Bullish Strategies: Long calls, bull call spreads

- Bearish Strategies: Long puts, bear put spreads

- Neutral Strategies: Iron condors, straddles, strangles

- Volatility Plays: Calendar spreads, Vega-sensitive trades

Match your strategy to your risk tolerance and market outlook.

4. Risk Management

Position Sizing: Avoid over-leveraging by risking only a small portion of your capital on any single trade

Stop-Loss and Exit Strategies: Predefine your loss limits and profit targets

Hedging: Use options to hedge your portfolio against adverse market movements

5. Time Management

Options are time-sensitive due to time decay (Theta). Plan trades with an understanding of how time impacts option value

6. Capital and Liquidity

Ensure sufficient capital for margin requirements, especially for advanced strategies

Trade liquid options with tight bid-ask spreads to minimize trading costs

7. Brokerage Platform

Choose a reliable trading platform with advanced tools, low fees, and robust support for options trading

8. Continuous Education

Stay updated with market news, earnings reports, and economic data

Learn advanced concepts, such as volatility skew, synthetic positions, and adjustments

9. Emotional Discipline

Avoid impulsive decisions based on fear or greed

Stick to your trading plan and review performance regularly

10. Tax and Regulatory Awareness

Understand the tax implications of options trading in your region

Be aware of the rules governing options to avoid penalties or restrictions

Differences Between Option Buying and Option Selling

What is Options Trading?

An option is a financial contract that gives you the right, but not the obligation, to buy or sell an asset at a specific price within a certain time period. Unlike futures, you're not obligated to exercise the option.

Call Option

Right to BUY an asset at a specific price

Put Option

Right to SELL an asset at a specific price

Example

You buy a call option for Apple stock with a strike price of ₹15,000, paying a premium of ₹500. If Apple rises to ₹16,000, you can buy at ₹15,000 and profit ₹500 (₹1,000 gain - ₹500 premium). If it falls to ₹14,000, you lose only the ₹500 premium.

Types of Options

Call Options

Used when you expect the price to go UP

- Buy Call: Bullish strategy

- Sell Call: Bearish/neutral strategy

- Limited loss (premium paid)

- Unlimited profit potential

Put Options

Used when you expect the price to go DOWN

- Buy Put: Bearish strategy

- Sell Put: Bullish/neutral strategy

- Limited loss (premium paid)

- High profit potential

Exercise Styles

American Options

Can be exercised anytime before expiration

European Options

Can only be exercised on expiration date

‹ Options Chain ›

An Option Chain, also known as an Options Matrix, is a comprehensive table displaying all available option contracts for a specific stock, index, or asset. It is a critical tool for traders and investors to analyze options trading opportunities.

1. What is an Option Chain?

An Option Chain is a table displaying the available Call (CE) and Put (PE) option contracts for an underlying asset with details such as strike prices, premiums, open interest, and more.

For example, if you're analyzing the Nifty50 option chain, it will list contracts for different strike prices (e.g., ₹24,500, ₹24,600, etc.) and expiries (weekly or monthly).

2. Key Terms in an Option Chain

Underlying Asset

The stock or index on which the option contract is based.

Example: Nifty50, Bank Nifty, Reliance Industries, TCS, etc.

Call Option (CE)

Gives the buyer the right to buy the underlying at a specified price (strike price) on or before the expiry.

Example: If you buy a Nifty50 Call Option at a strike price of ₹24,600 for a premium of ₹120, you can buy Nifty50 at ₹24,600, irrespective of the market price.

Put Option (PE)

Gives the buyer the right to sell the underlying at a specified strike price.

Example: If you buy a Nifty50 Put Option at a strike price of ₹24,500 for a premium of ₹80, you can sell Nifty50 at ₹24,500.

Strike Price

The price at which the option can be exercised.

Example: In the option chain for Reliance Industries, you may see strike prices like ₹1,300, ₹1,400, and ₹1,450 etc.

Expiration Date

The last date on which the option can be exercised.

Example: Weekly Options expire every Thursday, while Monthly Options expire on the last Thursday of the month.

Premium

The price you pay to buy an option contract.

Example: If the premium of a Nifty50 Call at ₹24,600 is ₹100, the total cost for one contract (Lot size of 50) is ₹100 × 50 = ₹5,000.

Open Interest (OI)

The total number of outstanding contracts for a specific strike price.

Example: If the OI for a Nifty50 ₹24,500 Call is 1,50,000, it means 1,50,000 contracts are open.

Volume

The number of contracts traded during the day.

Example: If the volume for a strike price of ₹24,700 is 20,000, it means 20,000 contracts were traded.

In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM)

ITM: Favorable for the holder. If Nifty50 is at ₹24,600, a Call with strike ₹24,500 is ITM. A Put with strike ₹24,700 is ITM.

ATM: Strike price closest to current price. If Nifty50 is at ₹24,600, the ₹24,600 strike is ATM.

OTM: Unfavorable for the holder. If Nifty50 is at ₹24,600, a Call at ₹24,700 and Put at ₹24,500 are OTM.

3. Structure of an Option Chain

An option chain is divided into two sections:

Left Side: Call options

Right Side: Put options

Each section contains the following columns:

Strike Price: The central column lists the strike prices. Example: ₹50, ₹55, ₹60, etc.

Open Interest (OI): Total number of outstanding contracts for a strike price. Example: If OI is 1,000, it means 1,000 contracts are open.

Volume: Number of contracts traded on a given day. Example: If volume is 200, it means 200 contracts were traded.

Last Traded Price (LTP): The last price at which the option was traded. Example: If LTP is ₹2, the option was last traded at ₹2 per share.

Bid Price: The highest price buyers are willing to pay. Example: Bid price is ₹3.

Ask Price: The lowest price sellers are willing to accept. Example: Ask price is ₹3.5.

Option Greeks (Advanced Analysis)

Delta: Sensitivity to price changes in the underlying asset.

Theta: Time decay impact on the premium.

Vega: Impact of volatility on the premium.

Gamma: Rate of change of Delta.

4. Example of a Nifty50 Option Chain

Suppose Nifty50 is trading at ₹24,600. Here is a snippet of the option chain:

Interpretation:

1. At ₹24,600 (current price), the strike price ₹24,600 is ATM.

2. The Call at ₹24,500 is ITM, and the premium is ₹120.

3. The Put at ₹24,700 is OTM, and the premium is ₹150.

5. How to Use an Option Chain?

Trading Strategies

Bullish View:

Buy Call Options (CE) or Sell Put Options (PE).

Example: Nifty50 is at ₹24,600, expect it to rise. Buy a ₹24,700 Call for ₹50. If Nifty50 rises to ₹24,800, the Call premium might increase to ₹120.

Bearish View:

Buy Put Options (PE) or Sell Call Options (CE).

Example: Nifty50 is at ₹24,600, expect it to fall. Buy a ₹24,500 Put for ₹60. If Nifty50 falls to ₹24,400, the Put premium might increase to ₹150.

Identifying Support and Resistance

Strike prices with high Open Interest (OI) often act as support or resistance levels.

Example: ₹24,500 Call has OI of 1,20,000 → Likely Resistance. ₹24,500 Put has OI of 1,10,000 → Likely Support.

Hedging

Use options to protect against losses.

Example: If you own Nifty50 stocks and fear a fall, buy a Put option at ₹24,500. If market falls, the Put gains value, offsetting losses.

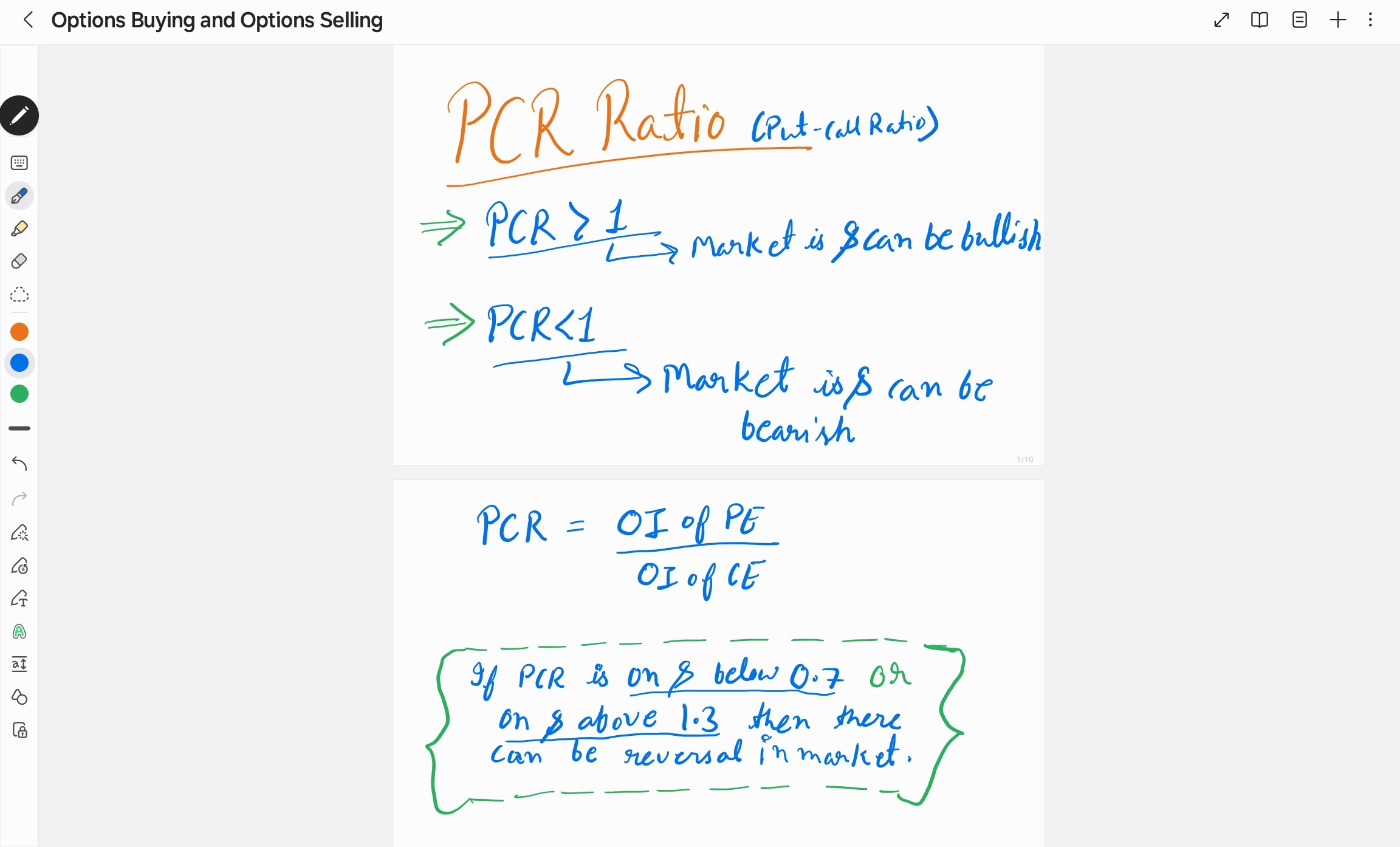

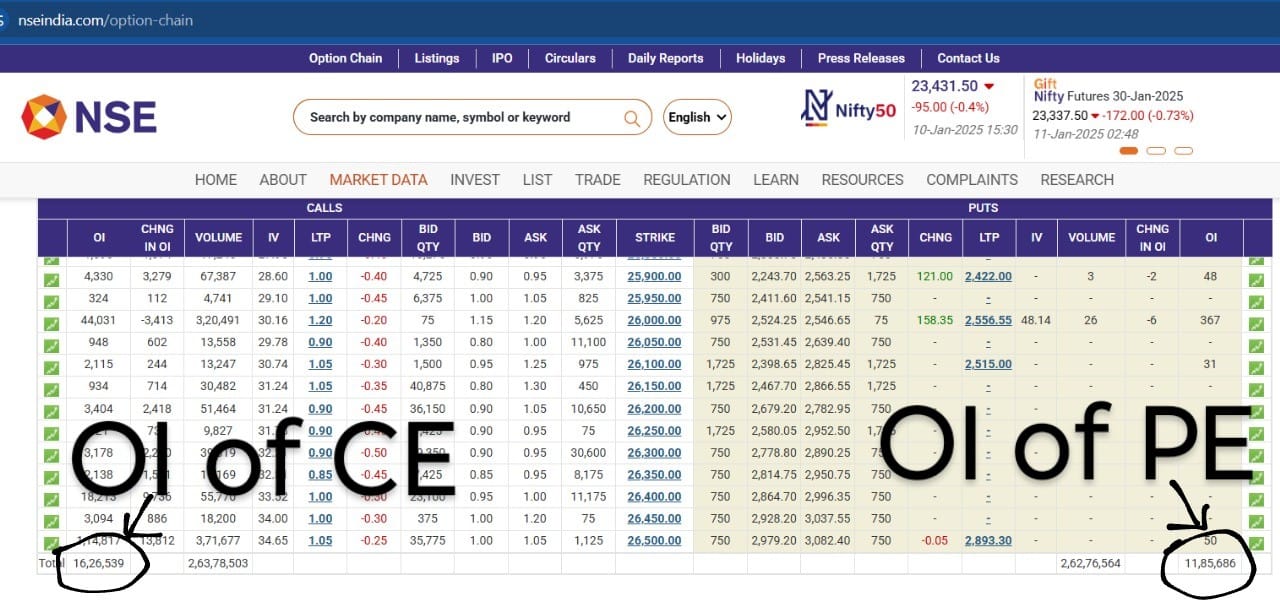

⇜ PCR RATIO ⇝

If PCR is below 0.7 then it is considered to be over sold zone and can reverse to level the market. Same as this, if PCR is 1.3 then it is considered to be over bought zone and can reverse to level the market.

Key Options Trading Terminologies

Strike Price

The predetermined price at which you can buy (call) or sell (put) the underlying asset.

Premium

The cost of buying an option. This is the maximum loss for option buyers and the maximum profit for option sellers.

Expiration Date

The last day you can exercise the option. Options lose value as they approach expiration (time decay).

In-the-Money (ITM), At-the-Money (ATM), Out-of-the-Money (OTM)

ITM

Option has intrinsic value

ATM

Strike = Current price

OTM

No intrinsic value

Greeks

Mathematical measures that help assess option sensitivity:

Popular Options Trading Strategies

Basic Strategies

Long Call

Buy call when bullish. Limited risk, unlimited reward.

Long Put

Buy put when bearish. Limited risk, high reward potential.

Short Call

Sell call when neutral/bearish. Limited reward, unlimited risk.

Short Put

Sell put when neutral/bullish. Limited reward, high risk.

Intermediate Strategies

Bull Call Spread

Buy low strike call, sell high strike call. Limited risk and reward.

Bear Put Spread

Buy high strike put, sell low strike put. Limited risk and reward.

Straddle

Buy call and put with same strike. Profit from high volatility.

Strangle

Buy call and put with different strikes. Lower cost than straddle.

Comprehensive Guide For Options Buying

Options trading can be a powerful investment strategy if you understand the mechanics, strategies, and risks. This guide will take you through options buying, breaking down every concept, method, and strategy in simple terms with examples.

What Are Options?

Options are financial contracts that give the buyer the right (but not the obligation) to buy or sell an asset (like stocks) at a predetermined price (strike price) on or before a specified date (expiration date).

Key Terms:

1. Call Option: Gives the buyer the right to buy the asset at the strike price.

2. Put Option: Gives the buyer the right to sell the asset at the strike price.

3. Premium: The cost of buying an option.

4. Strike Price: The price at which the underlying asset can be bought or sold.

5. Expiration Date: The date when the option contract expires.

6. Intrinsic Value: The value of the option if exercised now.

7. Time Value: The portion of the premium that reflects the remaining time until expiration.

Why Buy Options?

- Leverage: Small initial investment for potentially large returns.

- Hedging: Protects against downside risk in a portfolio.

- Speculation: Profiting from price movements without owning the underlying asset.

Steps to Buy Options

1. Understand Market Direction:

- Buy a Call if you expect the price to go up.

- Buy a Put if you expect the price to go down.

2. Choose the Right Option:

- Expiration Date: Decide how long you expect the price to move.

- Strike Price: Pick a price close to your target for profitability.

- Liquidity: Ensure the option has high trading volume.

3. Analyze Costs and Risk:

- The premium is the maximum risk for buyers.

- Profits are unlimited for calls and substantial for puts, depending on price movement.

4. Place the Trade:

- Use a brokerage account to execute the trade.

Deep Dive into Strategies

1. Buying Calls (Bullish Strategy)

Objective: Profit from a rising stock price.

Example:

- Stock Price: ₹100

- Call Option Strike Price: ₹105

- Premium: ₹2

- Break-even: ₹105 + ₹2 = ₹107

- If stock rises to ₹110:

Profit = (₹110 - ₹105) - ₹2 = ₹3 per share

2. Buying Puts (Bearish Strategy)

Objective: Profit from a falling stock price.

Example:

- Stock Price: ₹100

- Put Option Strike Price: ₹95

- Premium: ₹3

- Break-even: ₹95 - ₹3 = ₹92

- If stock drops to ₹90:

Profit = (₹95 - ₹90) - ₹3 = ₹2 per share

Factors Affecting Options Prices

1. Intrinsic Value:

- Call: Stock Price - Strike Price

- Put: Strike Price - Stock Price

2. Time Decay:

- Options lose value as expiration approaches, even if the stock price doesn't change.

3. Volatility:

- Higher volatility increases option premiums.

- Use implied volatility to gauge expected price movement.

4. Interest Rates:

- Changes in rates slightly affect options pricing.

Advanced Strategies for Buying Options

1. Long Straddle

Setup: Buy a call and a put with the same strike price and expiration.

When to Use: Expecting high volatility but unsure of the direction.

Example: Call and Put Strike Price: ₹100, Premiums: ₹3 each, Breakeven: ₹100 ± ₹6 (up or down).

2. Long Strangle

Setup: Buy a call and a put with different strike prices.

When to Use: Expecting high volatility but lower premiums than a straddle.

Example: Call Strike Price: ₹105, Put Strike Price: ₹95, Premiums: ₹2 each.

3. Vertical Spread (Limited Risk and Reward)

Setup: Buy a call (or put) and sell another at a different strike price.

Example: Buy ₹100 call for ₹5, sell ₹110 call for ₹3. Net Premium = ₹2. Maximum Profit = ₹10 - ₹2 = ₹8.

4. Protective Put (Hedging)

Setup: Buy a put to protect a long stock position.

When to Use: To limit downside risk.

Example: Stock Price: ₹100, Put Strike Price: ₹95, Premium: ₹3. Maximum Loss = (₹100 - ₹95) + ₹3 = ₹8.

Risk Management in Options Buying

1. Define Risk: The premium paid is the maximum loss.

2. Position Sizing: Invest only a small portion of your capital in each trade.

3. Set Exit Rules: Have predefined profit targets or stop-loss levels.

4. Avoid Over-trading: Focus on high-probability trades, not frequent trades.

Common Mistakes to Avoid

1. Ignoring Time Decay: Time decay accelerates as expiration nears.

2. Chasing Low Premiums: Cheap options are often far out-of-the-money and unlikely to be profitable.

3. Over-leveraging: Buying too many contracts increases risk.

4. Ignoring Volatility: High implied volatility inflates premiums, making it harder to profit.

Example of a Full Trade

1. Scenario: Stock XYZ is trading at ₹100. You believe it will rise to ₹120 in 2 months.

2. Action: Buy a 2-month call option with a ₹110 strike price for ₹4.

3. Outcome:

- If stock hits ₹120: Profit = (₹120 - ₹110) - ₹4 = ₹6

- If stock stays below ₹110: Loss = Max ₹4 premium

Tools and Resources

1. Options Chains: Use brokerage platforms to analyze strike prices, premiums, and expiration dates.

2. Greeks:

- Delta: Measures sensitivity to price changes

- Theta: Measures time decay

- Vega: Measures sensitivity to volatility

3. Backtesting Platforms: Practice strategies before committing real money.

Deep Dive Into Profitable Options Buying

Understanding the profit potential of options is critical for success. Unlike stocks, options have unique dynamics involving strike prices, time decay, volatility, and expiration.

1. Components of Profit in Options

Profit Formula for Call Options:

Profit = (Stock Price at Expiration - Strike Price) - Premium Paid

If stock stays below strike price, you lose only the premium paid.

Profit Formula for Put Options:

Profit = (Strike Price - Stock Price at Expiration) - Premium Paid

If stock stays above strike price, you lose only the premium paid.

Maximum Profit:

- Calls: Theoretically unlimited as stock prices can rise infinitely

- Puts: Limited to strike price minus premium (stock can only drop to ₹0)

2. Break-Even Point

The break-even point is the price the stock needs to reach for the buyer to recover the cost of the option.

Call Option Break-Even:

Break-Even = Strike Price + Premium Paid

Example: Stock ₹100, Strike ₹105, Premium ₹3

Break-Even: ₹105 + ₹3 = ₹108

If stock exceeds ₹108, option generates profit.

Put Option Break-Even:

Break-Even = Strike Price - Premium Paid

Example: Stock ₹100, Strike ₹95, Premium ₹2

Break-Even: ₹95 - ₹2 = ₹93

If stock drops below ₹93, option generates profit.

3. Full Profit Scenarios

Call Option Full Profit Example:

Stock XYZ: Current Price ₹100, Strike ₹110, Premium ₹5

Scenario:

Stock Price at Expiration = ₹130

Profit = (₹130 - ₹110) - ₹5 = ₹15 per share

If bought 1 contract (100 shares), total profit = ₹15 × 100 = ₹1,500

Put Option Full Profit Example:

Stock XYZ: Current Price ₹100, Strike ₹95, Premium ₹4

Scenario:

Stock Price at Expiration = ₹80

Profit = (₹95 - ₹80) - ₹4 = ₹11 per share

If bought 1 contract (100 shares), total profit = ₹11 × 100 = ₹1,100

4. Impact of Time Decay on Profits

Time decay (Theta) reduces option value as expiration approaches, particularly for out-of-the-money options. Timing the entry and exit is crucial.

Example: Strike ₹110, Stock ₹100, Premium ₹5

If stock stays at ₹100 as expiration nears, option loses value and expires worthless.

To maximize profits:

- Trade closer to the money options with sufficient time to expiration

- Consider exiting profitable trades early to avoid rapid time decay

5. Role of Implied Volatility in Profit

Implied Volatility (IV) represents the market's expectation of price swings. It affects option premiums.

How Volatility Affects Profit:

- Higher IV: Increases premiums, giving more potential profit if stock moves in your favor

- Lower IV: Reduces premiums, leading to smaller profits or losses

Example: A call option priced at ₹5 with high IV might increase to ₹10 due to increased market uncertainty, even if stock price hasn't moved much.

6. Scaling Profit: Using Multiple Contracts

Example:

Stock XYZ: Current Price ₹100, Strike ₹110, Premium ₹5

Scenario: Buy 5 contracts (500 shares total)

Stock Price at Expiration = ₹130

Profit = (₹130 - ₹110 - ₹5) × 500 = ₹15 × 500 = ₹7,500

7. Strategies to Maximize Profits

A. Out-of-the-Money Options (High Risk, High Reward)

Cheapest options but require large price movements to become profitable.

Example: Stock ₹100, Strike ₹120, Premium ₹1

If stock hits ₹130, profit = (₹130 - ₹120 - ₹1) = ₹9 per share

B. In-the-Money Options (Safer, Lower Reward)

Higher premium but already profitable at current prices.

Example: Stock ₹100, Strike ₹90, Premium ₹12

If stock hits ₹130, profit = (₹130 - ₹90 - ₹12) = ₹28 per share

C. Long Straddle (Profit from High Volatility)

Buy both a call and a put at the same strike price.

Profit from large price movements in either direction.

8. Real-Life Full Profit Example

HDFC Options Trade:

Stock Price: ₹1600, Call Strike: ₹1650, Premium: ₹10, Lot: 100

Scenario 1: Stock Hits ₹1700 at Expiration

Profit = (₹1700 - ₹1650) - ₹10 = ₹40 per share = ₹4,000 per contract

Scenario 2: Stock Stays Below ₹1650

Loss = Premium Paid = ₹10 per share = ₹1,000 per contract

9. Tools to Track and Maximize Profits

1. Options Calculator: Tools like Options Profit Calculator help visualize potential profits.

2. Options Chains: Review implied volatility, premium, and liquidity before purchasing.

3. Greeks: Use Delta to measure sensitivity to stock price changes. Use Theta to understand time decay impact.

10. Key Tips for Maximizing Full Profit Potential

1. Choose the Right Strike Price: For aggressive profit, pick slightly OTM options. For safer trades, pick ITM options.

2. Manage Timing: Avoid buying options too close to expiration unless certain about price movement.

3. Leverage Volatility: Enter trades when implied volatility is low and expected to rise.

4. Exit Early: Consider taking profits before expiration to lock in gains.

Important Note: The profit potential in options buying is substantial but comes with risks like time decay and volatility swings. By understanding how profits are generated, using appropriate strategies, and managing risks effectively, you can maximize your returns in the options market.

By mastering these principles, strategies, and tools, you can effectively navigate the world of options buying to achieve your financial goals.

Comprehensive Guide For Options Selling

Options selling involves writing (selling) options contracts, giving the buyer the right to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) before a specific date (expiration date). Sellers (also called writers) profit by collecting premiums from buyers but take on the obligation to fulfill the contract if exercised.

1. Key Concepts in Options Selling

1.1 Options Basics

Call Option: Buyer has the right to buy an asset at the strike price.

Put Option: Buyer has the right to sell an asset at the strike price.

Premium: The price the buyer pays to the seller for the option contract.

Strike Price: The agreed-upon price for the asset in the contract.

Expiration Date: The date by which the option must be exercised or it expires worthless.

1.2 Selling vs Buying Options

Buyers: Limited loss (premium paid) but unlimited profit potential.

Sellers: Limited profit (premium received) but significant risk.

2. Why Sell Options?

Time Decay (Theta): Options lose value as expiration nears. Sellers benefit from this.

High Probability of Profit: Many options expire worthless, allowing sellers to keep the premium.

Flexibility: Can create income and hedge existing positions.

3. Methods of Options Selling

3.1 Covered Call

Sell a call option while holding the underlying stock.

Example:

Own 100 shares of XYZ stock priced at ₹1,000.

Sell a ₹1,050 call for a ₹20 premium.

Outcome:

If XYZ stays below ₹1,050, keep the ₹20 premium.

If XYZ rises above ₹1,050, sell the stock at ₹1,050 and keep the ₹20 premium.

3.2 Cash-Secured Put

Sell a put option with enough cash reserved to buy the stock if assigned.

Example:

Sell a ₹950 put on XYZ for ₹30 premium.

Outcome:

If XYZ stays above ₹950, keep the ₹30 premium.

If XYZ drops below ₹950, buy the stock at ₹950 (effective cost: ₹950 - ₹30 = ₹920).

3.3 Naked Options

Selling options without holding the underlying asset.

High risk: Unlimited loss potential (for calls) or significant loss (for puts).

3.4 Spread Strategies (Risk-Defined)

Combine buying and selling options to limit risk.

Bull Put Spread

Example: Sell ₹1,000 put for ₹100 and buy ₹950 put for ₹50.

Max Profit = Premium Collected (₹100 - ₹50 = ₹50).

Max Loss = ₹50 (Difference in Strikes - Premium).

Bear Call Spread

Example: Sell ₹1,000 call for ₹120 and buy ₹1,050 call for ₹80.

Max Profit = ₹40.

Max Loss = ₹50 - ₹40 = ₹10.

Iron Condor

Combine a bull put spread and a bear call spread.

Example:

Sell ₹1,000 put for ₹30, buy ₹950 put for ₹10.

Sell ₹1,100 call for ₹30, buy ₹1,150 call for ₹10.

Profit if stock stays between ₹1,000 and ₹1,100.

Iron Butterfly

Sell at-the-money call and put and buy out-of-the-money call and put.

Example:

Sell ₹1,000 call for ₹50, sell ₹1,000 put for ₹50.

Buy ₹1,050 call for ₹20, buy ₹950 put for ₹20.

Max Profit = ₹60 (Premium Collected).

4. Risk Management

Key Points:

Define Max Loss: Use spread strategies to cap losses.

Position Sizing: Never risk more than 2-3% of your portfolio on one trade.

Diversification: Avoid overexposure to a single stock or sector.

5. Advanced Options Selling Strategies

5.1 Short Strangle

Sell an out-of-the-money call and put on the same asset.

Example: Sell ₹1,100 call for ₹30 and ₹900 put for ₹30. Profit if stock stays between ₹900 and ₹1,100.

5.2 Short Straddle

Sell at-the-money call and put options.

Example: Sell ₹1,000 call for ₹50 and ₹1,000 put for ₹50. Profit if stock remains near ₹1,000.

5.3 Jade Lizard

Combine a short put and a short call spread.

Example: Sell ₹950 put for ₹30. Sell ₹1,050 call for ₹30. Buy ₹1,100 call for ₹10. Max Profit = ₹50.

5.4 Calendar Spread

Sell a short-term option and buy a longer-term option at the same strike price.

Example: Sell ₹1,000 call expiring in 1 month for ₹30. Buy ₹1,000 call expiring in 3 months for ₹60. Profit from time decay in short-term option.

6. Understanding the Greeks in INR Context

Delta: Indicates how much the option price changes with a ₹1 move in the stock. Example: Delta = 0.3 → Option premium changes by ₹0.30 for every ₹1 move.

Theta: Indicates time decay. Sellers benefit as options lose value closer to expiration.

Vega: Indicates sensitivity to volatility. High implied volatility = Higher premiums for sellers.

7. Factors Influencing Options Pricing

Implied Volatility (IV): High IV = Higher premiums, good for sellers. Low IV = Lower premiums, less attractive for selling.

Time Decay (Theta): Shorter-dated options decay faster, benefiting sellers.

Underlying Asset Price: Options are affected by movements in the stock price.

8. Tips for Indian Traders

Sell Options with High Probability: Target options with a delta of 0.2-0.3 (approx. 70-80% chance of expiring worthless).

Use Technical Analysis: Identify support/resistance levels to choose strike prices.

Sell During High Volatility: Higher premiums during volatile markets.

Avoid Earnings Events: Unexpected price moves can lead to losses.

Use Nifty and Bank Nifty Options: High liquidity and lower chances of manipulation. Example: Sell Nifty 24,000 CE for ₹150; profit if Nifty stays below 24,000.

Focus on High-Probability Trades: Sell options with a delta of 0.2-0.3 (70-80% chance of expiring worthless).

Monitor Volatility: Use India VIX to assess market volatility. High VIX = Higher premiums.

Avoid Holding to Expiry: Close trades early if 50-70% of the premium is captured.

Key Takeaways

Risk-Defined Strategies: Use spreads to cap potential losses.

Sell Options with High Premiums: Focus on out-of-the-money options with high time decay.

Diversify Trades: Spread positions across various strike prices and expiration dates.

Practice with Paper Trading: Gain experience before committing real money.

9. Risks of Options Selling

Assignment Risk: Options can be exercised at any time before expiration.

Margin Requirements: Naked options require high margin, increasing capital at risk.

Market Gaps: Sudden price movements can lead to significant losses.

Till now this guide provides a deep dive into options selling. Before concluding lets discuss all the advance strategies for OPTION SELLING you need.

Advanced Options Selling Strategies

1. Calendar Spread (Time Spread)

A strategy that involves selling a short-term option and buying a longer-term option at the same strike price.

Goal: Profit from time decay in the short-term option while benefiting from the longer-term option's retained value.

Example:

Stock: XYZ trading at ₹100

Sell: 1-month ₹100 call for ₹2

Buy: 3-month ₹100 call for ₹5

Outcomes:

- If XYZ remains near ₹100, the short-term option decays faster, resulting in a net gain.

- If XYZ moves sharply, the longer-term option retains value, minimizing losses.

2. Diagonal Spread

Similar to a calendar spread but involves different strike prices.

Goal: Capture time decay and take advantage of directional price movement.

Example:

Stock: XYZ trading at ₹100

Sell: 1-month ₹105 call for ₹2

Buy: 3-month ₹110 call for ₹4

Outcomes:

- If XYZ rises slowly, the sold call decays faster, creating a profit.

- If XYZ rises above ₹110, the long call offsets the loss from the short call.

3. Ratio Spread

Sell more options than you buy, creating a directional bias.

Goal: Generate income with limited risk.

Example:

Stock: XYZ trading at ₹100 (Bullish Ratio Spread)

Sell: 2 ₹90 puts for ₹3 each

Buy: 1 ₹95 put for ₹2

Outcomes:

- If XYZ stays above ₹90, both sold puts expire worthless, and you keep a net premium.

- If XYZ falls below ₹90, you face increased risk but have limited protection from the purchased put.

4. Short Straddle

Sell at-the-money call and put options.

Goal: Profit from minimal price movement and time decay.

Example:

Stock: XYZ trading at ₹100

Sell: ₹100 call for ₹3, ₹100 put for ₹3

Outcomes:

- If XYZ stays at ₹100, both options expire worthless, and you keep ₹6.

- If XYZ moves significantly in either direction, losses are theoretically unlimited.

5. Short Strangle

Similar to a short straddle but involves selling out-of-the-money call and put options.

Goal: Profit from a range-bound market.

Example:

Stock: XYZ trading at ₹100

Sell: ₹110 call for ₹2, ₹90 put for ₹2

Outcomes:

- If XYZ stays between ₹90-₹110, both options expire worthless, and you keep ₹4.

- If XYZ moves outside this range, losses are theoretically unlimited.

6. Jade Lizard

A combination of a short put and a short call spread.

Goal: Generate premium with no upside risk.

Example:

Stock: XYZ trading at ₹100

Sell: ₹90 put for ₹2, ₹105 call for ₹2

Buy: ₹110 call for ₹1

Outcomes:

- Max profit: Premium collected (₹3).

- Limited downside risk below ₹90.

- No risk above ₹110 (the long call offsets further losses).

7. Iron Fly (Iron Butterfly)

Combines selling a straddle with buying protective wings (out-of-the-money call and put).

Goal: Profit from minimal price movement with limited risk.

Example:

Stock: XYZ trading at ₹100

Sell: ₹100 call for ₹3, ₹100 put for ₹3

Buy: ₹110 call for ₹1, ₹90 put for ₹1

Outcomes:

- Max profit: Premium collected (₹4).

- Max loss: ₹10 - ₹4 = ₹6 (difference between strikes minus premium).

8. Broken-Wing Butterfly

Similar to an Iron Fly but shifts one wing further out to create a directional bias.

Goal: Profit from directional price movement with reduced risk.

Example:

Stock: XYZ trading at ₹100 (Bearish Broken-Wing Butterfly)

Sell: 2 ₹100 calls for ₹3 each

Buy: ₹105 call for ₹1

Buy: ₹90 call for ₹0.5

Outcomes:

- If XYZ drops or remains stagnant, you profit from time decay.

- If XYZ rises above ₹105, losses are limited.

9. Credit Box Spread

A combination of a bull put spread and a bear call spread.

Goal: Lock in a small credit by exploiting mispriced options.

Example:

Stock: XYZ trading at ₹100

Sell: ₹95 put for ₹1, buy ₹90 put for ₹0.5 (bull put spread)

Sell: ₹105 call for ₹1, buy ₹110 call for ₹0.5 (bear call spread)

Outcomes:

- Max profit: Credit collected.

- Losses occur only if there's an extreme price move beyond ₹90 or ₹110.

10. Poor Man's Covered Call

A leveraged alternative to a covered call, using a deep-in-the-money call instead of owning the stock.

Goal: Generate income with less capital.

Example:

Stock: XYZ trading at ₹100

Sell: 1-month ₹105 call for ₹2

Buy: 1-year ₹70 call for ₹35

Outcomes:

- Max profit: Premium collected (₹2).

- Losses are limited to the cost of the long call minus any premiums collected.

11. High-Probability Delta Selling

Sell options with low delta (e.g., 0.1-0.3) to create a high probability of success.

Goal: Consistent income with minimal risk.

Example:

Stock: XYZ trading at ₹100

Sell: ₹115 call with a delta of 0.2 for ₹1

Outcomes:

- Probability of profit: ~80%.

- Risk increases if XYZ approaches ₹115.

Additional Concepts and Tips

1. The Greeks and Their Role

Delta: Measures price sensitivity. Helps assess directional risk.

Theta: Time decay. Sellers benefit as options lose value over time.

Vega: Sensitivity to implied volatility. Avoid selling options in low-volatility environments.

Gamma: Measures changes in delta. Lower gamma means less risk for sellers.

2. Choosing Expiration Dates

Short-Term Options: Higher time decay but riskier due to price movement.

Long-Term Options: Slower time decay but safer for beginners.

3. Volatility Management

Implied Volatility (IV):

- Sell options when IV is high (premiums are higher).

- Avoid selling options when IV is low (less reward for the risk).

Example: Stock XYZ IV: 30%. Sell ₹110 call when IV is high, as the premium will decay more rapidly if volatility decreases.

4. Adjustments and Exiting Trades

Roll Forward: Extend expiration to collect more premium or avoid assignment.

Close Early: Take profits when 50-75% of the premium is collected.

Key Takeaways

Understand Risk: Use defined-risk strategies (e.g., spreads) to minimize losses.

Sell High-Probability Options: Focus on options with a high chance of expiring worthless.

Diversify: Spread trades across different assets and expiration dates.

Monitor Trades: Adjust positions as needed to optimize profitability.

Risk Management in Options Trading

1. Position Sizing

Risk only 1-2% of your capital per trade. Example: With ₹50,000 capital, risk maximum ₹500-1,000 per options trade.

2. Time Decay Management

Options lose value as expiration approaches. Avoid buying options close to expiry unless you expect immediate price movement.

3. Volatility Awareness

High implied volatility means expensive options. Consider selling strategies when volatility is high and buying when it's low.

4. Diversification

Don't put all capital in options. Mix with stocks, bonds, and other assets to reduce overall portfolio risk.

When to Trade Options

Best Times to Buy Options

- When implied volatility is low

- Before earnings announcements

- During strong trending markets

- When you have strong directional bias

Best Times to Sell Options

- When implied volatility is high

- In range-bound markets

- Close to expiration (time decay)

- When premium is rich

Step-by-Step Options Trading Process

1. Market Analysis

Analyze the underlying asset using technical and fundamental analysis to determine direction and timing.

2. Strategy Selection

Choose the appropriate options strategy based on your market outlook (bullish, bearish, or neutral).

3. Strike Price & Expiration

Select optimal strike price and expiration date. Consider time decay and volatility.

4. Risk Assessment

Calculate maximum loss, maximum profit, and breakeven points before entering the trade.

5. Execute the Trade

Place your order with proper position sizing. Use limit orders to control entry price.

6. Monitor & Manage

Track the position daily. Adjust stop-loss levels and consider early exit if target is hit.

7. Exit Strategy

Close positions when profit target is reached, stop-loss is hit, or before expiration.

Common Options Trading Mistakes to Avoid

❌ Buying Options Close to Expiry

Time decay accelerates rapidly. Options can become worthless quickly even with favorable price movements.

❌ Ignoring Volatility

High implied volatility makes options expensive. Price can move in your favor but you still lose due to volatility crush.

❌ Overtrading

Taking too many positions reduces capital efficiency and increases commission costs.

❌ No Exit Plan

Always have profit targets and stop-losses defined before entering any options position.

Conclusion

Options trading offers flexibility and defined risk strategies but requires deep understanding and discipline. To succeed:

- Master the basics before attempting complex strategies

- Always consider time decay and volatility impact

- Practice with paper trading before risking real money

- Focus on risk management over profit maximization

- Keep learning and adapting your strategies

Options can be powerful tools when used correctly. Start small, learn continuously, and build your expertise gradually.