Crypto Market Learning Index

Complete guide to master cryptocurrency trading

Foundation Concepts

Advanced Trading

Chart Patterns

Master chart patterns to identify potential market trends, reversals, and breakout opportunities in cryptocurrency trading.

What are Chart Patterns?

Chart patterns are specific shapes or formations that appear on financial asset price charts. They are used in technical analysis to predict future price movements based on historical price data. These patterns are created by fluctuations in price and can provide insights into potential market trends or reversals.

Chart patterns work on the RBC principle: Reversal, Breakouts/Breakdowns, Continuation

Main Categories of Chart Patterns

Continuation Patterns

Suggest that the current trend (uptrend or downtrend) will continue after the pattern is completed.

Reversal Patterns

Indicate a potential reversal in the current trend direction.

How to Use Chart Patterns

Steps to Follow

Identify the Pattern: Recognize the specific shape or formation on the chart

Confirm with Volume: Many patterns are confirmed by changes in trading volume

Determine Entry and Exit Points: Based on breakout direction and pattern projection

Why Chart Patterns Are Useful

Forecast Trends: Help traders anticipate market movements

Visual Simplicity: Provide clear visual representation of market psychology

Risk Management: Help set stop-loss and take-profit levels

Most Used Chart Patterns

Ascending Triangle Pattern

A breakout pattern that forms when the price breaches the upper horizontal trendline with rising volume. It is a bullish formation indicating potential upward movement.

Descending Triangle Pattern

An inverted version of the ascending triangle, considered a breakdown pattern. The lower trendline is horizontal, connecting near identical lows, while the upper trendline declines diagonally.

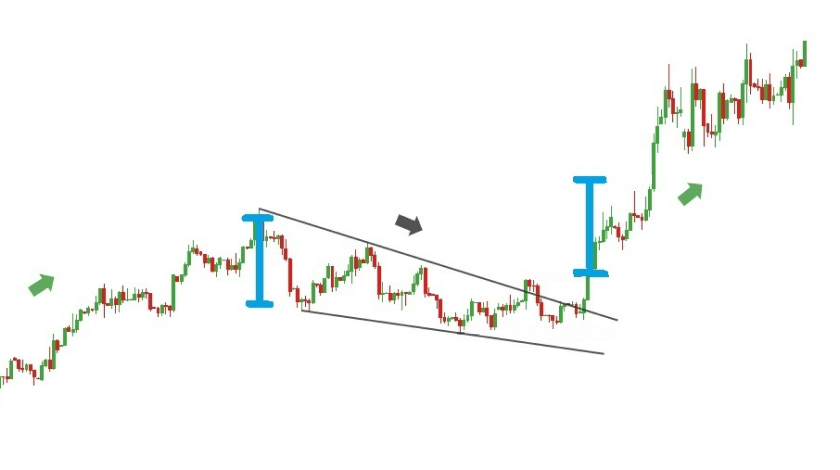

Bullish Flag Pattern

Consists of a long upward trend, followed by a short period of downward consolidation before an upward breakout. Volume increases during the upward trend and decreases during consolidation.

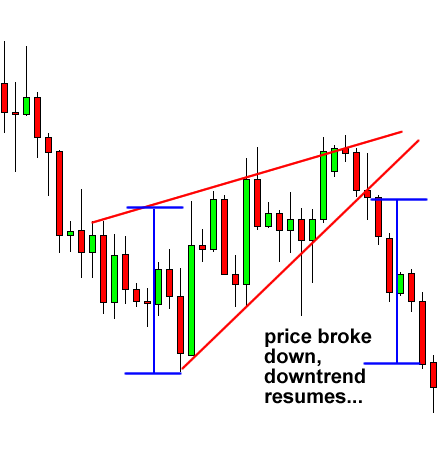

Bearish Flag Pattern

The inverse of a bull flag pattern. Looks like a downtrend with increasing volume, followed by a short upward consolidation with decreasing volume, until the downtrend resumes.

Bullish Wedge Pattern

Falling wedges are always considered bullish signals. They develop when a narrowing trading range has a downward slope, with subsequent lows and highs falling as trading progresses.

Bearish Wedge Pattern

Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive upward slope. Both subsequent lows and highs rise as the range narrows.

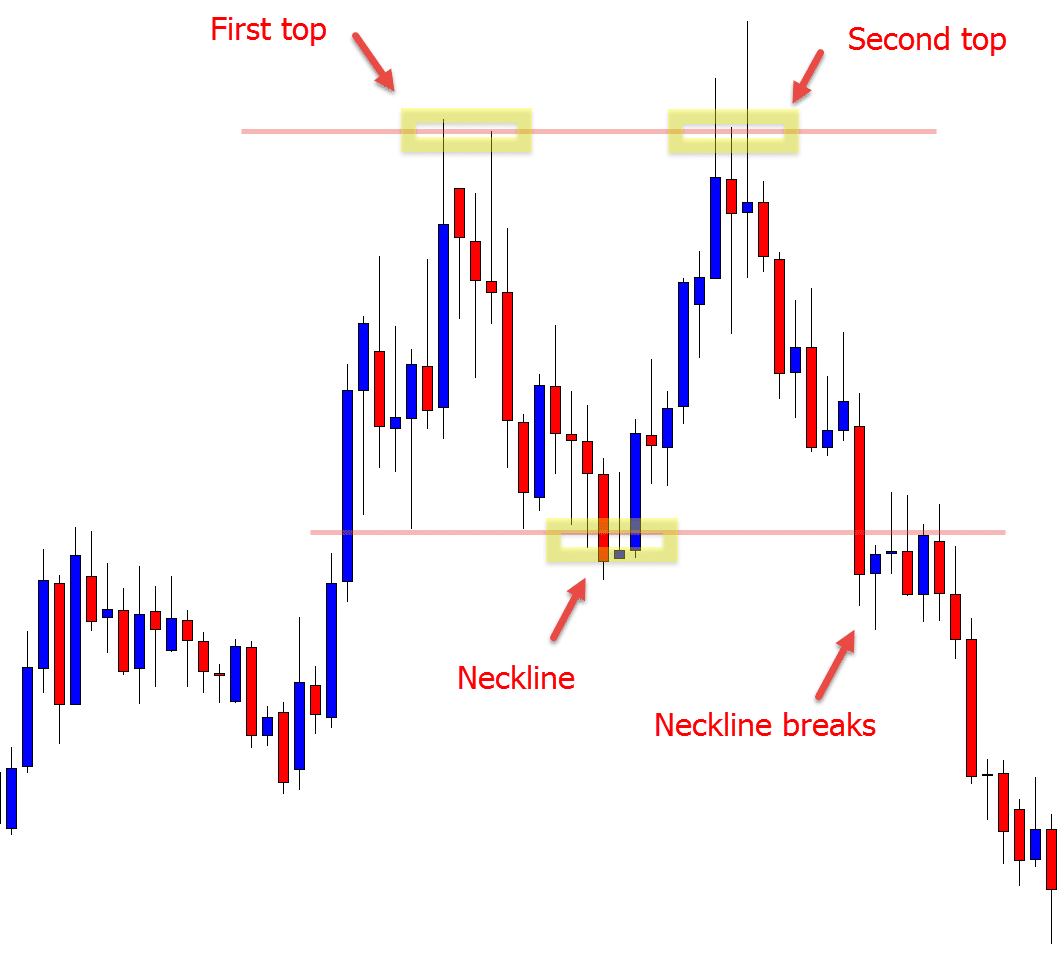

M / Double Top Pattern

Formed from two consecutive rounding tops. The first rounding top forms an upside-down U pattern. Often an indicator for bearish reversal after an extended bullish rally.

W / Double Bottom Pattern

Essentially opposite of double top patterns. Formed following a single rounding bottom pattern which can be the first sign of a potential bullish reversal.

Triple Top Pattern

Rarer than double tops in rising trends. Volume is usually low during the second rally and lesser during the third top formation. Confirmed when price falls below the lowest valley between peaks.

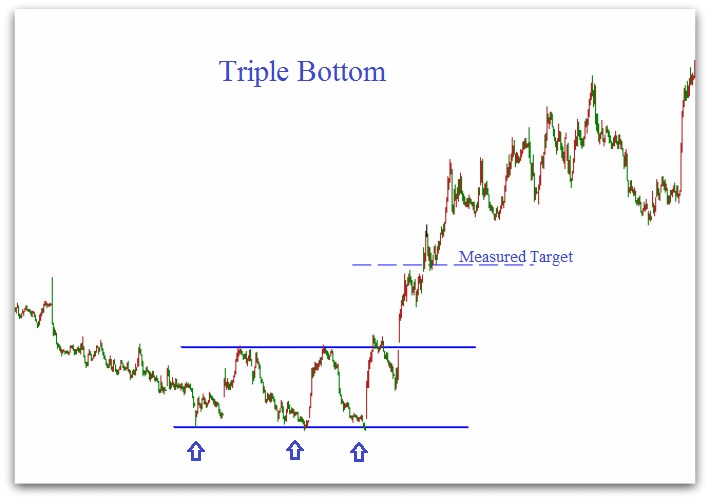

Triple Bottom Pattern

Most rules from triple top can be reversed for triple bottom formation. The third low should be on low volume with the rally showing marked increase in activity.

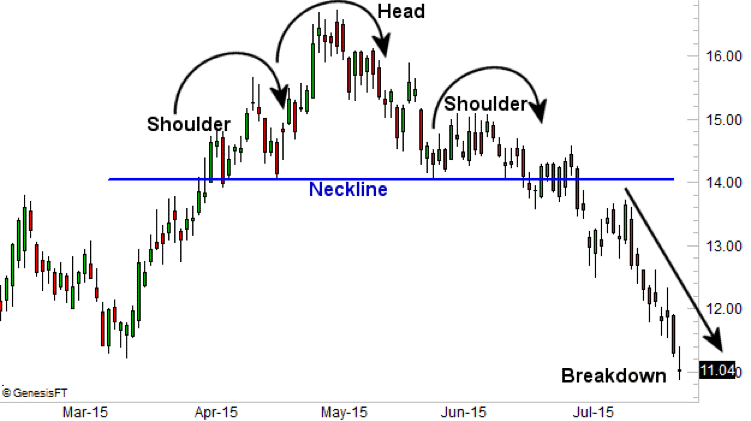

Head & Shoulders Pattern

Forms when stock price rises to a peak, declines to base, rises above previous peak to form the head, declines back, then peaks again at about the level of the first peak before falling.

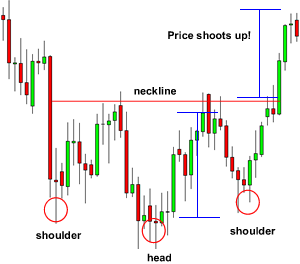

Inverse Head & Shoulders Pattern

The opposite of head and shoulders chart, also called head and shoulders bottom. Inverted pattern used to predict reversals in downtrends.

Important Reminder

Always remember that chart patterns are not absolute. We cannot rely on a single indicator alone. Sometimes the market will not move even after showing the same patterns. We should use these tools in combination with candlestick patterns and price action analysis to reduce errors and improve trading accuracy. Use a combination of (chart patterns + candlestick patterns + price action) for better results and higher probability trades.