Stock Market Learning Index

Complete guide to master stock market trading

Foundation Concepts

Stock Market Basics

What is stock market and how it works?

Market Terms

All important market terminology

Trade Types

Different types of trades

Trading Styles

Various approaches to trading

Candlestick Patterns

Bullish, Bearish & Continuation patterns

Chart Patterns

Technical chart analysis

Support & Resistance

Key price levels identification

Market Analysis

Technical, Fundamental & Price Action

Advanced Trading

Chart Patterns Mastery

Master the art of reading price charts and predicting market movements through pattern recognition

Chart patterns are specific shapes or formations that appear on a stock chart or other financial asset's price chart. They are used in technical analysis to predict future price movements based on historical price data. These patterns are created by fluctuations in price and can provide insights into potential market trends or reversals.

RBC Framework

Chart patterns work on the RBC principle:

Reversal

Breakouts/Breakdowns

Continuation

Main Categories of Chart Patterns

1. Continuation Patterns

Suggest that the current trend (uptrend or downtrend) will continue after the pattern is completed.

2. Reversal Patterns

Indicate a potential reversal in the current trend direction.

How to Use Chart Patterns Effectively

Pattern Usage Steps

- 1Identify the Pattern: Recognize the specific shape or formation on the chart

- 2Confirm with Volume: Many patterns are confirmed by changes in trading volume

- 3Determine Entry and Exit Points: Based on breakout direction and pattern projection

Why Chart Patterns Are Useful

- Forecast Trends: Help traders anticipate market movements

- Visual Simplicity: Provide visual representation of market psychology

- Risk Management: Help set stop-loss and take-profit levels

Important Note: Chart patterns are not foolproof and should be used alongside other forms of analysis, such as indicators, fundamentals, and risk management strategies.

Most Used Chart Patterns

Ascending Triangle Pattern

A breakout pattern that forms when the price breaches the upper horizontal trendline with rising volume. It is a bullish formation indicating potential upward movement.

Descending Triangle Pattern

An inverted version of the ascending triangle, considered a breakdown pattern. The lower trendline is horizontal, connecting near identical lows, while the upper trendline declines diagonally.

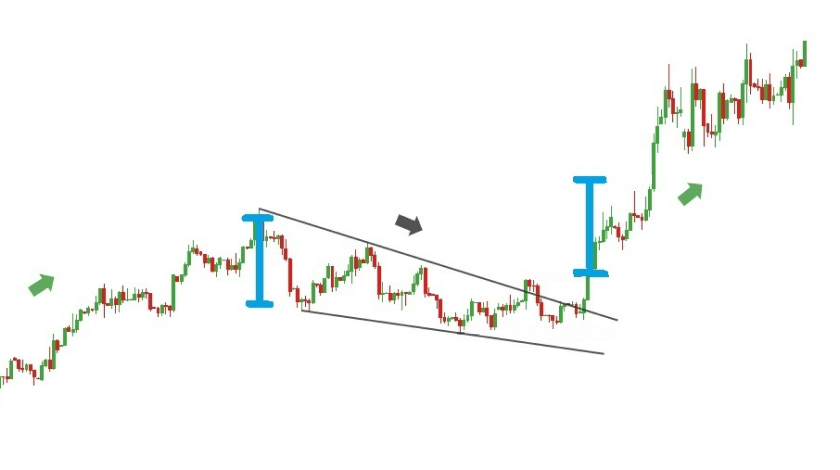

Bullish Flag Pattern

Consists of a long upward trend, followed by a short period of downward consolidation before an upward breakout. Volume increases during the upward trend and decreases during consolidation.

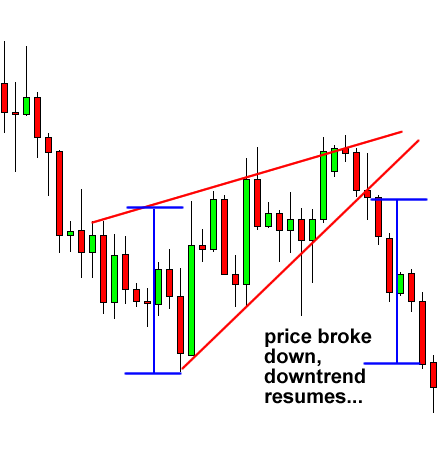

Bearish Flag Pattern

The inverse of a bull flag pattern. Looks like a downtrend with increasing volume, followed by a short upward consolidation with decreasing volume, until the downtrend resumes.

Bullish Wedge Pattern

Falling wedges are always considered bullish signals. They develop when a narrowing trading range has a downward slope, with subsequent lows and highs falling as trading progresses.

Bearish Wedge Pattern

Rising wedges are bearish signals that develop when a trading range narrows over time but features a definitive upward slope. Both subsequent lows and highs rise as the range narrows.

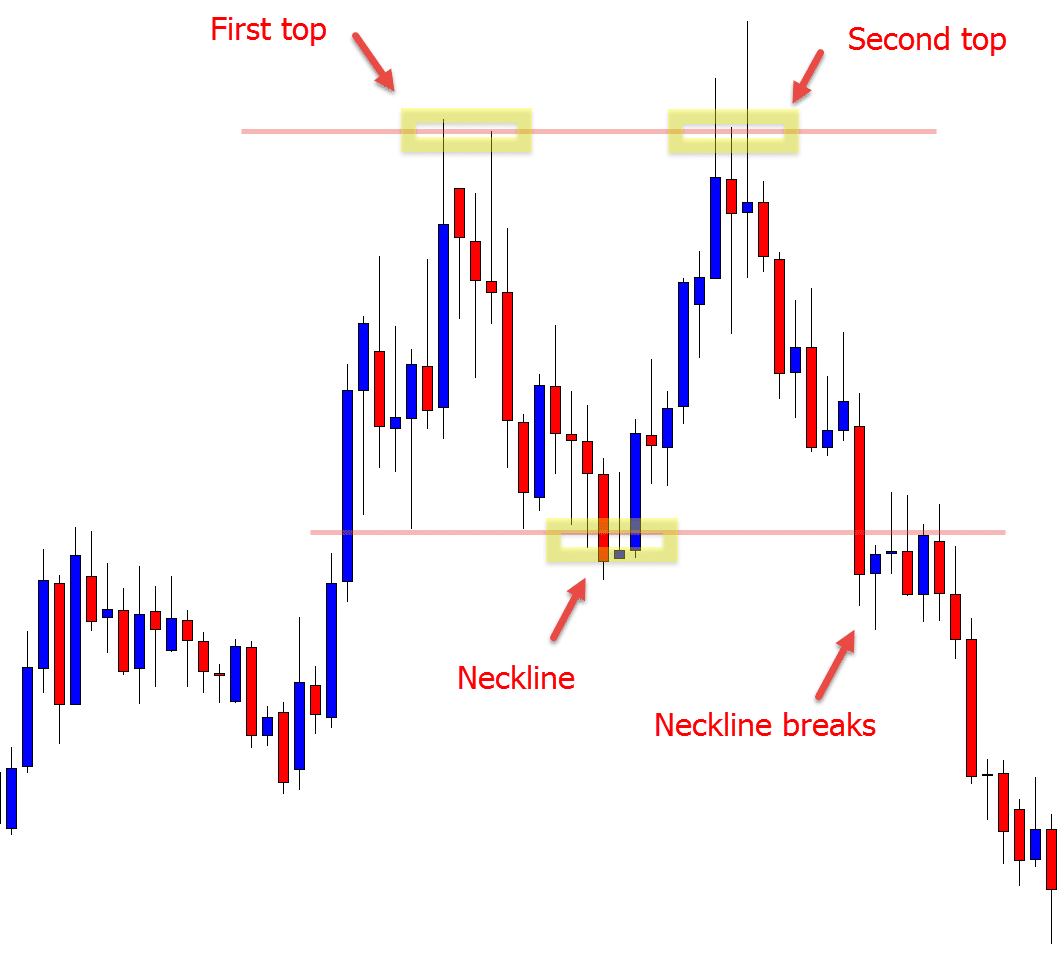

M / Double Top Pattern

Formed from two consecutive rounding tops. The first rounding top forms an upside-down U pattern. Often an indicator for bearish reversal after an extended bullish rally.

W / Double Bottom Pattern

Essentially opposite of double top patterns. Formed following a single rounding bottom pattern which can be the first sign of a potential bullish reversal.

Triple Top Pattern

Rarer than double tops in rising trends. Volume is usually low during the second rally and lesser during the third top formation. Confirmed when price falls below the lowest valley between peaks.

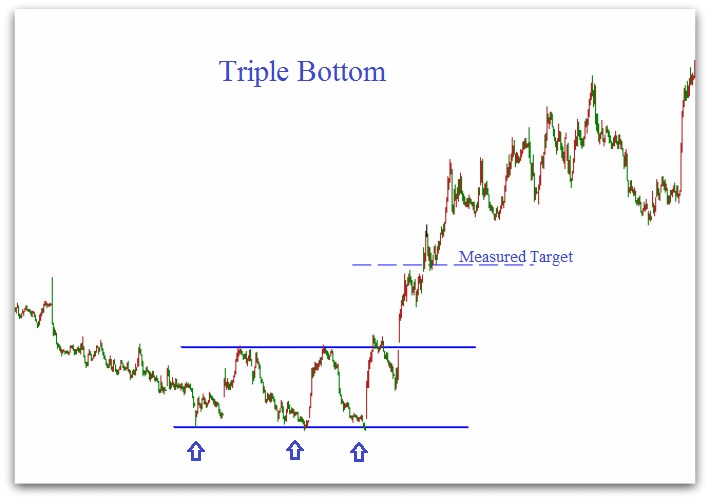

Triple Bottom Pattern

Most rules from triple top can be reversed for triple bottom formation. The third low should be on low volume with the rally showing marked increase in activity.

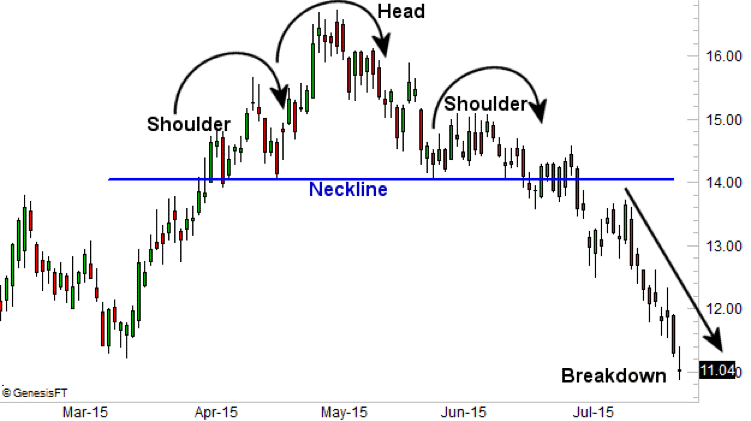

Head & Shoulders Pattern

Forms when stock price rises to a peak, declines to base, rises above previous peak to form the head, declines back, then peaks again at about the level of the first peak before falling.

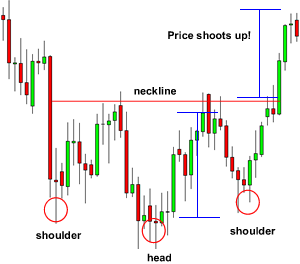

Inverse Head & Shoulders Pattern

The opposite of head and shoulders chart, also called head and shoulders bottom. Inverted pattern used to predict reversals in downtrends.

Critical Trading Reminder

Always remember chart patterns are not absolute. We cannot rely on one single thing. Sometimes the market will not move even after showing the same patterns, so we should only use all these things as tools for reducing errors and making our trades better.

Best Practice: Always use a combination of (chart patterns + candlestick patterns + price action) to reduce errors and increase profit probability.

Pattern Recognition Tips

Volume Confirmation

Always look for volume spikes during breakouts. High volume confirms the validity of the pattern.

Time Frame Analysis

Patterns on higher time frames are generally more reliable than those on lower time frames.

Market Context

Consider the overall market trend and economic conditions when interpreting patterns.

False Breakouts

Be aware of false breakouts. Wait for confirmation before entering trades.

Risk Management

Always set stop-losses and position sizes based on pattern dimensions and your risk tolerance.

Multiple Confirmations

Use multiple technical indicators and analysis methods to confirm pattern signals.