Stock Market Learning Index

Complete guide to master stock market trading

Foundation Concepts

Stock Market Basics

What is stock market and how it works?

Market Terms

All important market terminology

Trade Types

Different types of trades

Trading Styles

Various approaches to trading

Candlestick Patterns

Bullish, Bearish & Continuation patterns

Chart Patterns

Technical chart analysis

Support & Resistance

Key price levels identification

Market Analysis

Technical, Fundamental & Price Action

Advanced Trading

Stock Market Analysis Guide

Master the art of trading and investing through comprehensive analysis techniques

Analysis Methods

Technical Analysis

Chart patterns and indicators

Fundamental Analysis

Company financials and valuation

Quantitative Analysis

Numbers and statistical data

Price Action

Pure price movement analysis

Understanding Each Analysis Method

Technical Analysis

Category/Group of indicators reading market on the basis of tools/charts is technical analysis

Fundamental Analysis

Study of Fundamentals of company like how much profit it is generating, its valuation, ROE, growth, company's reputation etc.

Quantitative Analysis

Trading on the basis of numbers, statistics like graphs, pie charts, how much profit is which part or sub-company generating etc. Basically taking trade on the basis of the numbers of that company.

Price Action

Analyzing the price or price movement of stock (Best For Trading)

Fundamental vs Technical Analysis

Fundamental Analysis

Considers a company's financial information and macroeconomic factors to determine the intrinsic value of its stock. This includes analyzing a company's financial statements, such as its balance sheet, income statement, and cash flow statement.

Technical Analysis

Focuses on statistical trends in a stock's price and volume over time to identify trading and investment opportunities. This involves analyzing technical charts and tools to identify patterns and create indicators.

Key Insight

Many investors use a combination of both fundamental and technical analysis to make investment decisions. Fundamental analysis can help identify targets, while technical analysis can help make trading decisions.

Pro Tip: For investing we mainly use FUNDAMENTAL ANALYSIS and for trading like swing or day trading we use TECHNICAL ANALYSIS because short-term chart patterns and news determine price movements over days or weeks.

How To Filter Out Stocks

If you are new to trading and do not know much about filtering stocks and want to play safe in market, you can use these filters in any screener.

ROCE

How efficiently the company uses its money to make profits

Free Cash Flow

Money left after paying all bills, available for savings or investments

Net Income

The final profit after subtracting all costs

Set these filters to high values and search. You will have a list of stocks filtered from 3000+ stocks to just 100-150 stocks approximately. You can research these for safe market play.

Factors to Consider for Investments

Consistently Profit Making

Meaning: The company earns money (makes a profit) regularly, year after year.

Example: Think of a shop that always sells enough products to make more money than it spends every month.

Debt Free

Meaning: The company doesn't owe money to anyone (like banks or lenders).

Example: Imagine someone running a business without ever needing to borrow money—they're financially independent.

High ROE (Return On Equity)

Meaning: This tells us how much profit a company makes with the money its shareholders have invested.

Example: If you give your friend ₹100 to start a small business and they earn ₹20 profit from it, the ROE is 20%. Higher is better.

Ethical Management

Meaning: The people running the company make fair and honest decisions and don't cheat or harm others.

Example: A manager who pays employees on time, treats customers well, and follows laws is ethical.

Specialty in its Sector

Meaning: The company is very good at doing one specific thing in its field (industry).

Example: A company making the best chocolates in the market is specialized in the chocolate business.

Value Investing

Meaning: Buying shares of a company when they are undervalued (cheap) compared to how much the company is really worth.

Example: If you find a ₹100 pair of shoes on sale for ₹50, you're getting great value—similarly, investors look for companies like this.

Good Dividend

Meaning: The company shares a part of its profits with its shareholders as a reward.

Example: If you own a piece of a bakery, they might give you free bread every month as a 'dividend' from their earnings.

Technical Analysis

All about technical analysis and how to do accurate technical analysis of stocks

We do technical analysis of company while trading. In this we highly rely on category/group of indicators and reading market on the basis of tools/charts in technical analysis.

Tools for Technical Analysis

- Drawing Tools

- Candlestick Patterns

- Chart Patterns

- Indicators

Purpose of Tools

- Understand the market condition

- Area of Value

- Entry Trigger

We combine these tools & make high probability trading setups.

Drawing Tools

- → Trendline

- → Trend Channel

- → Support & Resistance (see support and resistance section for more details)

- → Use to find area of value to trade from (buy low and sell high)

Chart Patterns

- • Quick assessment of strength, weakness, or equilibrium in the market

- • Useful as an entry trigger & understanding market condition

Indicators

- • A tool that takes historical data & applies a formula to it

- • "Summarize" the market price action and useful as an entry trigger

Common Trading Indicators

Volatility Cycle

Best to enter at low volatility period so you know volatility will increase from there. A high volatility period you don't know till when it will be up.

Average True Range

It measures the volatility. It can be used for Stop Loss.

Donchian Channel

Shows 20-day upper band + 20-day lower band + Avg. Can be used to identify potential buying set-up when price touches the outer band.

Moving Average

Mainly used for determining trend direction.

Professional Trading Examples

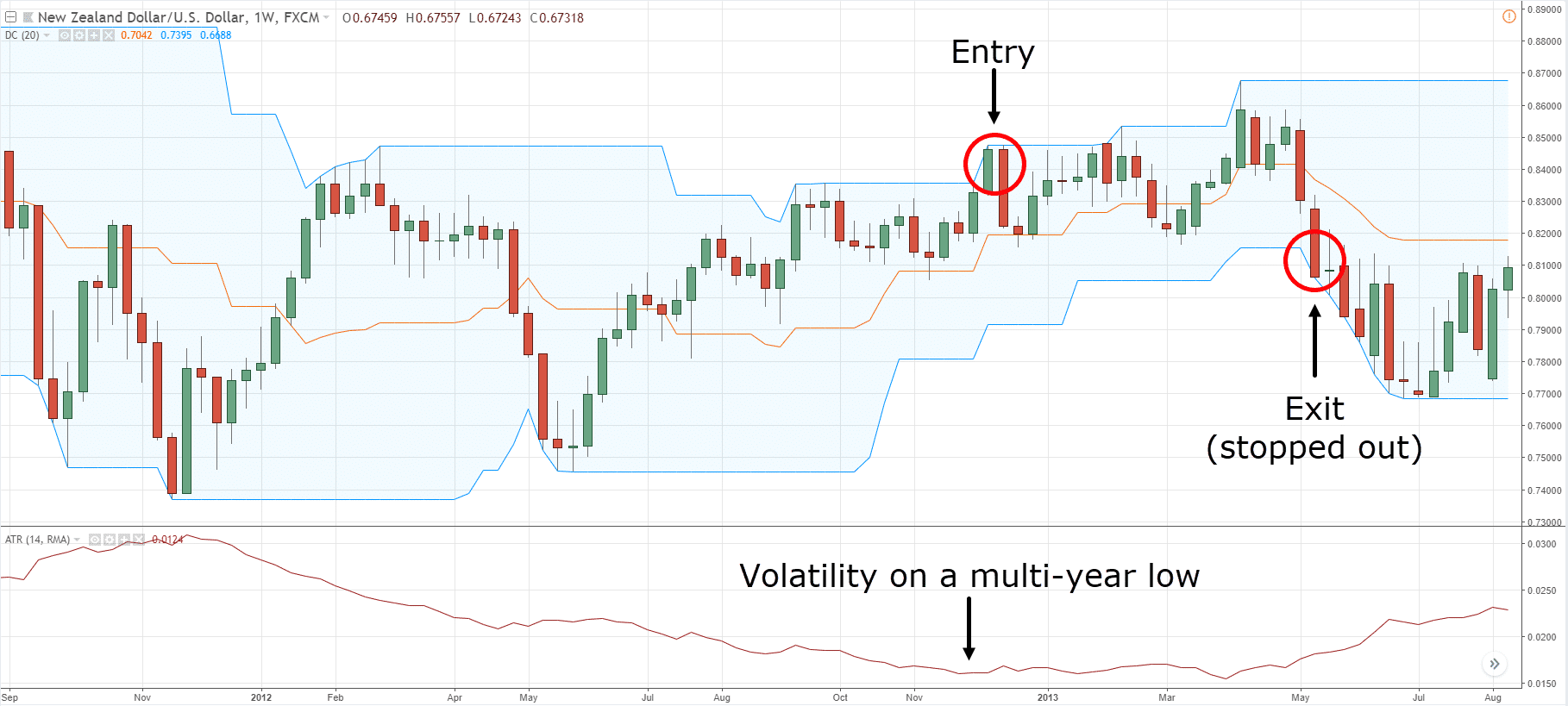

Donchian Channel + ATR

Set both indicators. If candlestick touches 20-day upper band in Donchian Channel and in ATR volatility is low, make entry there & exit when it touches 20-day lower band.

Moving Avg + Candlestick

Helps define area of value and patterns can help decide trend.

Resistance + Candlestick

If Tweezer Top patterns form at resistance level, it has potential for downtrend to start.

Fundamental Analysis

All about fundamental analysis and how to do accurate fundamental analysis of stocks

Study of fundamentals of company like how much profit it is generating, its valuation, ROE, Growth, who is the Owner/CEO, Company Reputation etc.

Fundamental Analysis Types

1. Qualitative Analysis

Analysis of those things which cannot be calculated through numbers like its product, service, reputation, competitors, management, future plans etc.

2. Quantitative Analysis

Analysis of company's profile on the basis of numbers like Balance Sheet, Income Statement, Cash Flow Statement & Financial Ratios.

Stock Selection Criteria for Your Hard-Earned Money

Additional Company Analysis Factors

1. Business Model

You should always see company's business model to see whether it is future proof or have some downfall in future if you are seeing for long term. EXAMPLE → CHEGG was one of the most growing companies for last years but after AI became famous and available to public its valuation was down by literally 95%+ in just last 2 years because now people use AI on their phones or any device for free to get answers.

2. Competitive Advantage

The company should have competitive advantages from their peers or should have edge. Example → if you go to buy chips most of the people go for lays just like that the company you choose should have some competitive advantage in its sector for good growth.

3. Special Key Advantage

Company should have some special advantages. Example → You see Hindustan Unilever have access to all the cities/villages...every corner of this Country so if they have X number of products and they think to launch their X+1th product so they don't have to struggle for delivering that to everywhere because they are present there with their old products.

4. Special Ratios

PRICE TO BOOK VALUE RATIO, PRICE TO EARNING RATIO, RETURN ON CAPITAL EMPLOYED, RETURN ON EQUITY SHOULD BE MORE THAN 10% FOR GOOD GROWTH

Financial Terms Reference

Price Action Analysis

The best way to analyze stocks through pure price movement

→ Analyzing the price or price movement of stock OR study of price is known as price action analysis.

→ Price Action is more precise than any other analysis

Technical Analysis vs Price Action

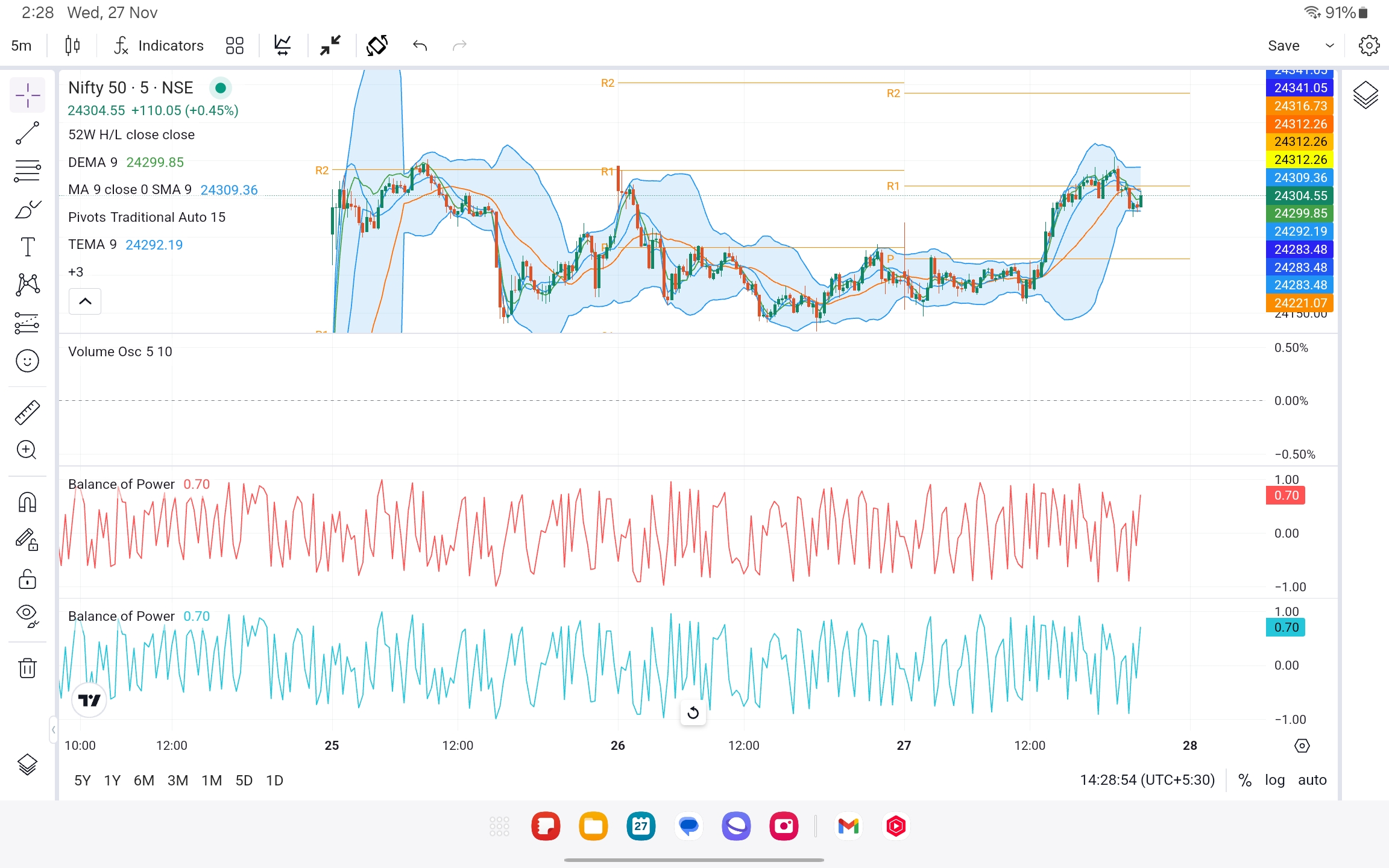

In technical analysis we rely on indicators, but indicators are lagging in nature that means they tell you the things that happened, and they create noise in chart means after putting indicators that chart becomes full and doesn't look good for analysis.

As you can see the chart looks so messy that it is very difficult to do analysis on this if we only rely on indicators and use too many indicators.

Example - Noisy/messy Chart

Price Action Strategies

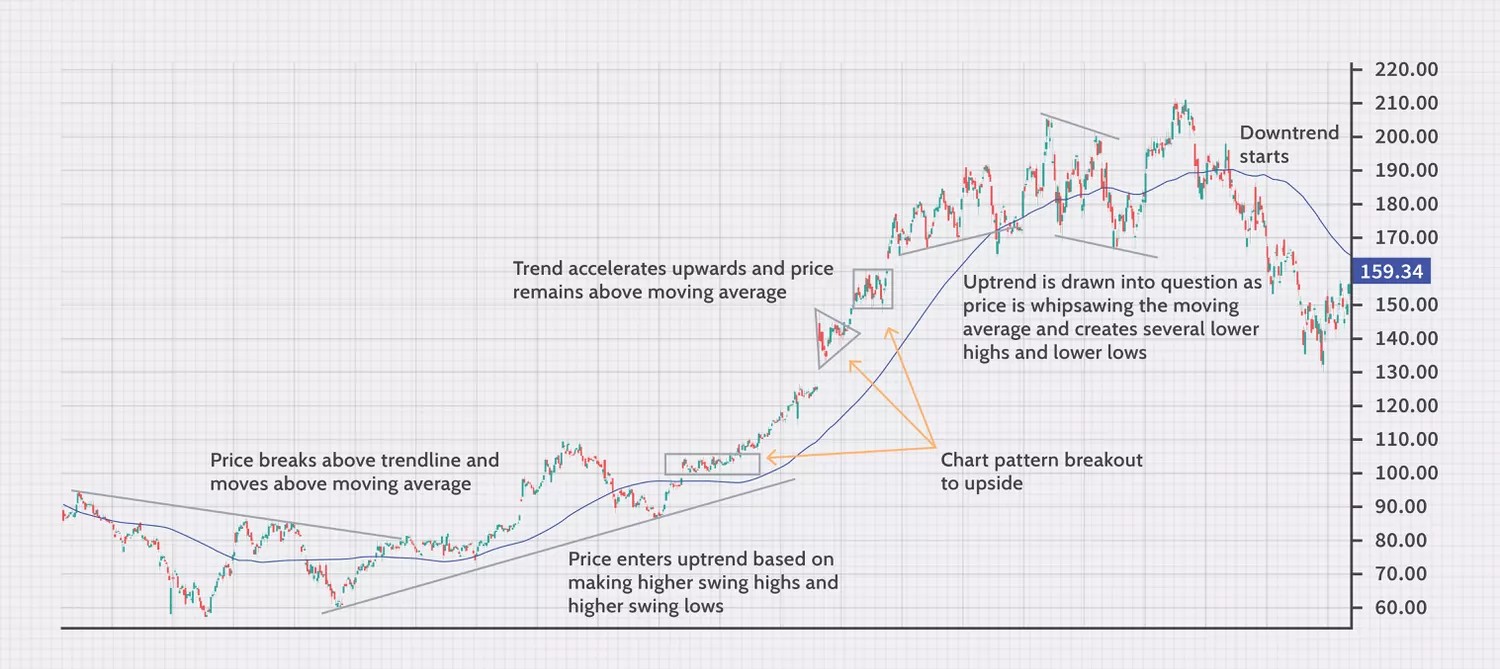

Trend Trading

Taking trades with the trend like if the market is going up or given breakout and charts and candlestick patterns are also indicating that the price may go more bullish so take upper calls and vice versa with bearish market.

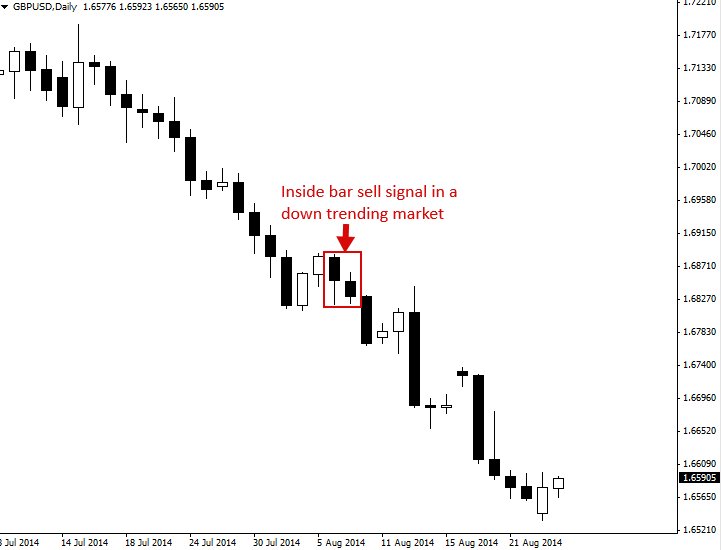

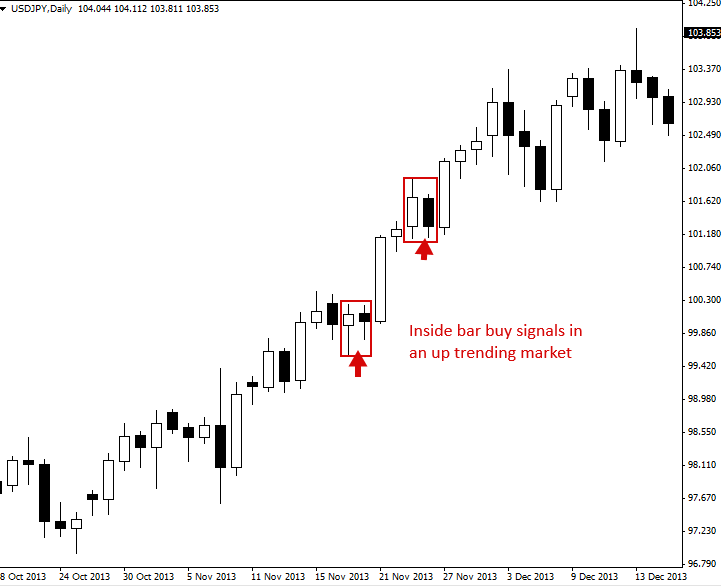

Inside Bar Strategy

Inside bars can be traded in trending markets in the direction of the trend, when traded this way they are typically referred to as a 'breakout play'. The classic entry is to place a buy stop or sell stop at the high or low of the mother bar.

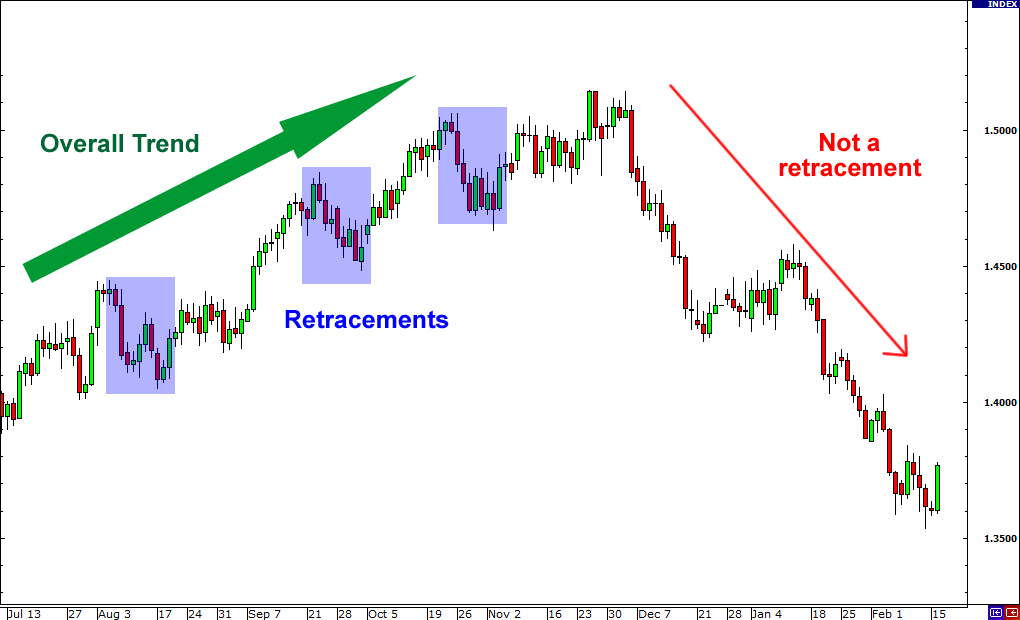

Retracements

Short term pullback or little correction is called retracement. A retracement is a technical term used to identify a minor pullback or change in the direction of a financial instrument. Retracements are temporary in nature and do not indicate a shift in the larger trend.

Reversal

A reversal is when the direction of a price trend has changed, from going up to going down, or vice-versa. Traders try to get out of positions that are aligned with the trend prior to a reversal. When it starts to occur, a reversal is not distinguishable from a pullback initially.

Breakouts & Breakdowns

Breakout → When the price of a security moves above a resistance level, signaling the start of an upward trend. Breakdown → When the price falls below a support level, signaling the start of a downward trend.

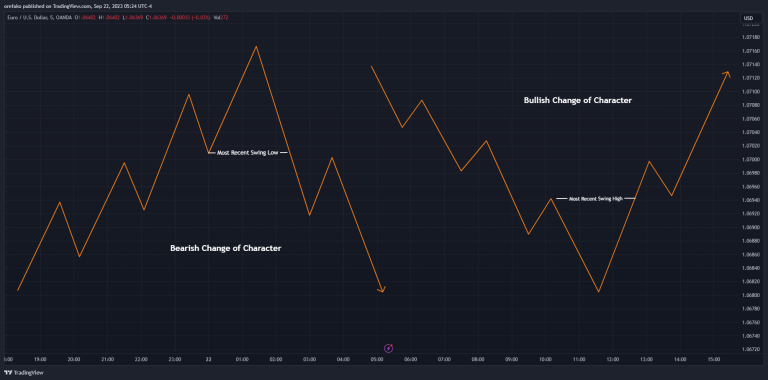

Change of Character

A Change of Character (ChoCh) in trading is a significant shift in the market's behavior or trend. It can indicate that a trend is losing momentum and a new trend is forming. It can be signaled by: a break in a previous trend line, an unusual volume spike, and a sudden increase in volatility.

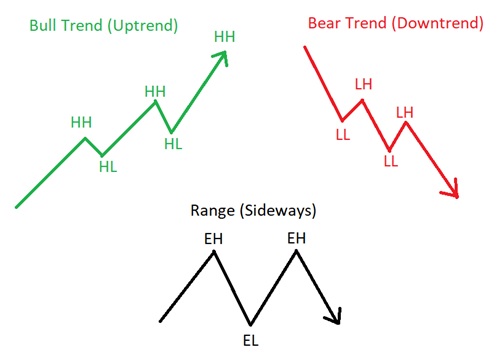

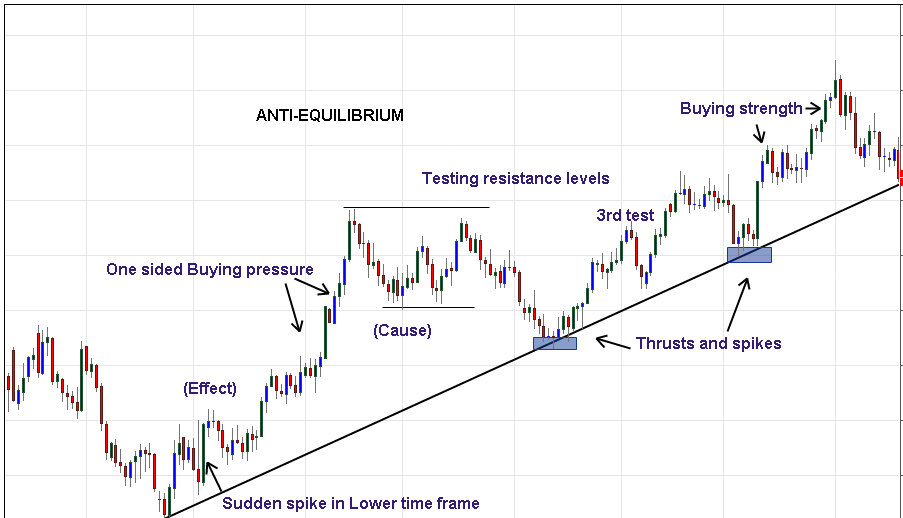

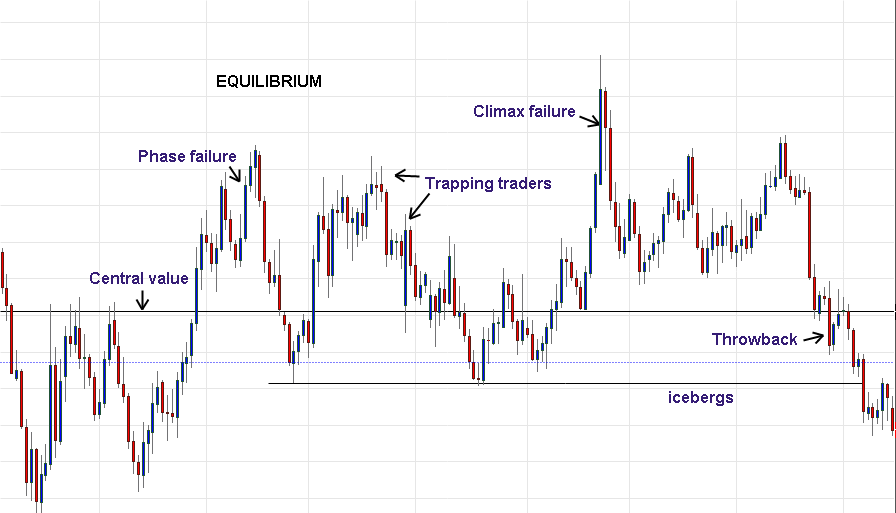

Market Structure

Traders can employ a range of techniques to effectively utilize market structure. One key aspect is identifying key support and resistance levels. Support levels are areas where buying pressure has been strong enough to prevent further price declines. Resistance levels are areas where selling pressure has halted price advances.

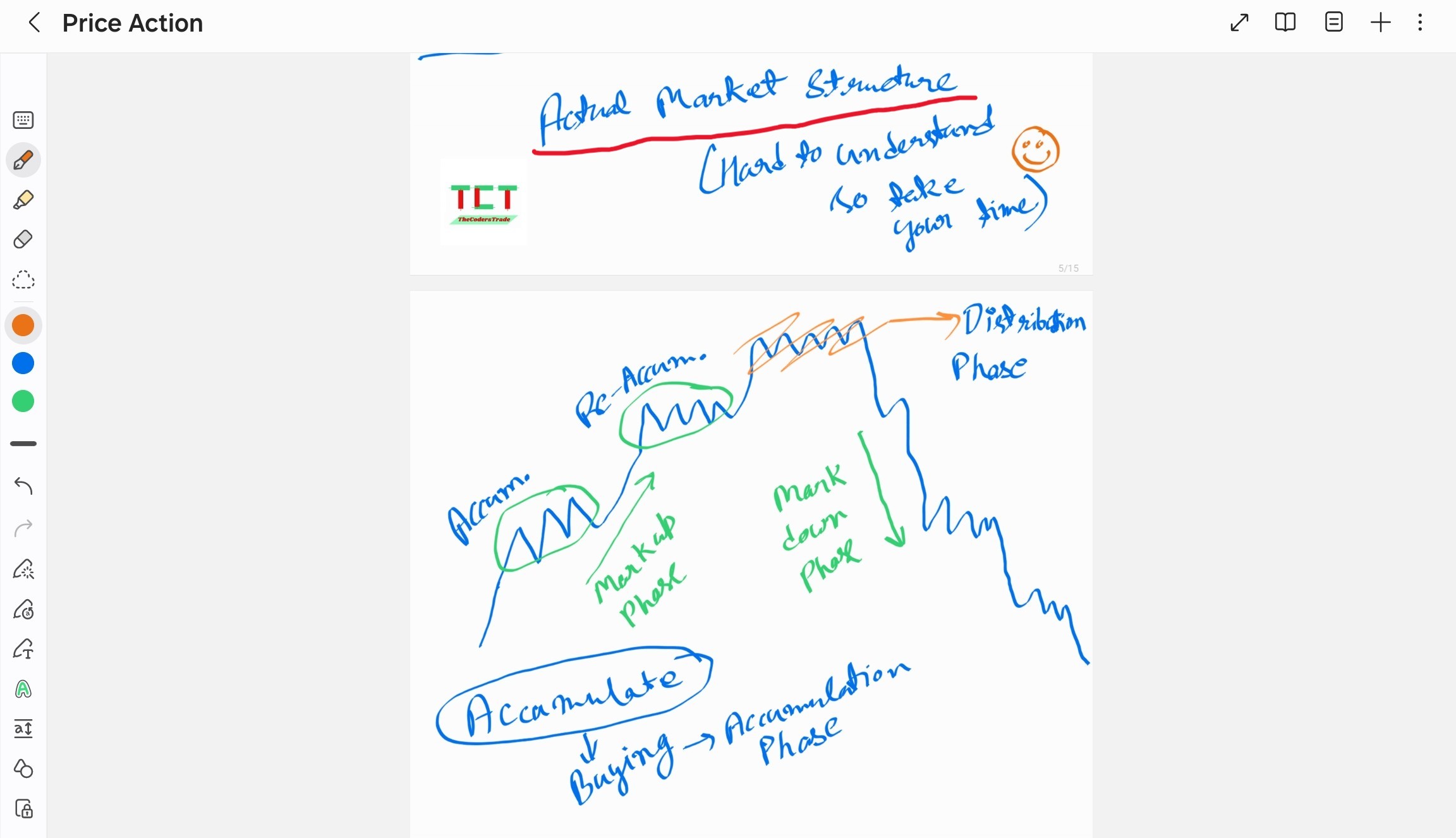

Actual Market Structure

Market structure is a representation of price action over time, while price action is the movement of prices up, down, or sideways. Market structure can be broken down into four stages: accumulation, advancing, distribution, and declining.

Markup Phase

The markup phase follows, measured by the slope of the new uptrend. Pullbacks to new support offer buying opportunities.

Markdown Phase

The slope of the new downtrend measures the markdown phase. This generates its own redistribution segments.

Market Structure Examples

Other Important Terms for Price Action

Demand & Supply → Hero of Price Action

• Demand ↑ = Supply ↓

• Supply ↑ = Price ↓

Support & Resistance

It is never just a line it is a zone i.e never make a line for support and resistance make a zone of area so that it can be easy to take entry.

FOR MORE INFO ABOUT SUPPORT AND RESISTANCE PLEASE REFER TO SUPPORT AND RESISTANCE SECTION

Candlesticks

FOR MORE INFO ABOUT CANDLESTICKS AND PATTERNS PLEASE REFER TO CANDLESTICKS SECTION

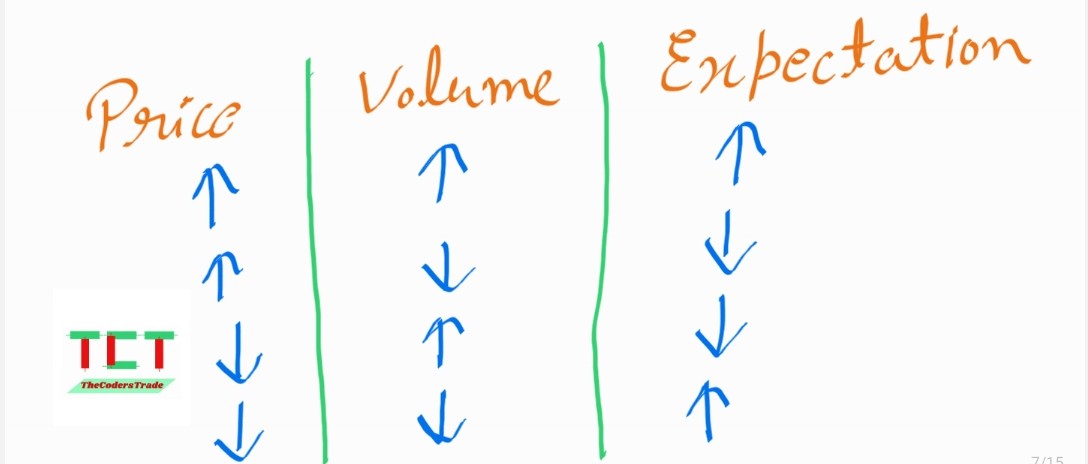

Volume

How much quantity is been traded at that moment is called volume.

Candlesticks Pattern + Support & Resistance + Volume + Chart Patterns etc.